STANDARD OPERATING PROCEDURE FOR PROSECUTION IN CASES

OF TDS/TCS DEFAULT

Introduction:

1.1 As per the Income Tax Act, all cases where TDS/TCS is deducted but not deposited within the due date, as prescribed, are punishable u/s 276B/276BB or 278A. The selection of cases & their processing is further governed by Instruction F.No. 285/90/2008-IT(Inv-I)/05 dated 24.04.2008 which has been modified by the CBDT [vide F.No.285/90/2013-IT(Inv.)] dated 07.02.2013. Presently, the monetary limit specified for cases to be considered for prosecution is as under:

(i) Cases, where amount of tax deducted is Rs.1,00,000 or more and the same is not deposited by the due date prescribed under the Income Tax Act, 1961 read with the Income Tax Rules, 1962 shall mandatorily be processed for prosecution in addition to the recovery.

(ii) Cases, where the tax deducted is between Rs.25,000 and Rs.1,00,000 and the same is not deposited by the due date prescribed under the Income Tax Act, 1961 read with the Income Tax Rules, 1962 may be processed for prosecution depending upon the facts and circumstances of the case, like where there are

instances of repeated defaults and/or tax has not been deposited till detection.

1.2 Thus, the present Instructions envisage two categories of cases for prosecution in TDS related offences; the first category is cases which are mandatorily to be processed (TDS of more than Rs. 1,00,000 deducted but not deposited before due date) and the second category is defaults between Rs. 25,000/- to 1,00,000/- which may be processed depending upon facts and circumstances of the cases.

Identification of cases:

2.1. CPC-TDS/TRACES will generate a list of prosecutable cases for mandatory processing for prosecution (List-A) in accordance with the criteria laid down by the CBDT vide it’s instruction dated 07.02.2013 or any other modified criteria, if the same is done in view of suggestions made in this regard. Such identification shall be done within one month of the filing of the quarterly TDS statement. CPC – TDS following the Instruction dated 07.02.2013, adopted following two parameters for identifying prosecutable case for mandatory processing:-

(i) where Late Payment Interest had not been paid completely/not paid at all till thatdate;

(ii) where deduction had been made but no challan was available in the account of the deductor i.e. the amount was not at all paid to the Government account. (Vide F.No. CPC(TDS)/Prose_cases/2014-15 dated 15.09.2014, limit of Rs. 1,00,000/-for the cases of Late Payment Interest and for Short Payment all the cases have been approved.)

2.2 CPC-TDS will generate another list of cases(List-B) involving defaults of delay in payment of Rs. 25,000 to Rs. 1,00,000/- along with default sheets for the year as well as preceding year and subsequent year ( if details are available), within one month of the filing of the quarterly TDS statement, to help AO(TDS) to identify cases fit for prosecution based on facts and circumstances of the case. The AO(TDS) can identify the cases from second list and also from the information gathered from external sources to complete identification of second

category of cases and enter them in prosecution register maintained manually or on utility to be provided by CPC-TDS.

2.3 It may be noted that the TDS cases, otherwise dealt by the International Taxation Division, with respect to payments made to non-residents also required to be dealt with in the same manner as other cases under Chapter-XVII of the Income Tax Act, 1961.

2.4 In cases of default in furnishing the quarterly TDS statement, CPC-TDS shall generate the list of such non-filers within one month from due date and communicate to the AO(TDS) for issue of notice and further pursuit.

Procedure for launching prosecution

3.1 After identification of potential cases for prosecution by the CPC – TDS in case of mandatory processing or otherwise, it should be entered in the ‘Prosecution register’ maintained in Form-C (page 74 of the Prosecution Manual) and to be reported to the CIT(TDS) who shall also maintain the prosecution register in Form-D (page 75 of the Prosecution Manual). Till a specific module in CPC-TDS is made functional for having control on prosecution proceedings, the entries may be made in manual register.

3.2 Following information/documents regarding the deductor may be collected by the AO(TDS) once the case is identified for processing :

(a) Details of the company/ firm/ individual

Name of the company/ Present PAN TAN

firm/individual address Number Number

(b) Details of its directors/ partners/ proprietor etc.

Name of Directors/ Partners/ Proprietor as Date of PAN & residential applicable for the relevant year birth address

(c) Accounts of the deductor for the relevant year showing late payments.

(d) Copies of the TDS statement filed by assessee deductor.

(e) Copies of challans of late deposit of TDS by the assessee deductor.

(f) Copies of the intimations showing late payment interest for all the quarters of the relevant assessment year, if it is available.

(g) Copies of Audit report, if they show default.

(h) While collecting above information, AO(TDS) may also collect other details that may help the CIT(TDS) take a considered decision as also assist subsequent compounding proceedings (if any) viz. (a) whether the default was only in one year and no defaults took place later, (b) whether the deductor has himself rectified the mistake and deposited the tax along with interest prior to issue of notice by the department, (c) whether the same offence has been compounded earlier and if yes, how many time etc.

3.3 The AO(TDS) after collecting the above information/documents shall issue show cause notices to the person responsible for deduction (directors/principal officers/partners/members/ karta), within 45 days of receipt of the list of prosecutable cases from CPC-TDS in accordance with Sections 278B/278C r.w.s. 276B/276BB of the Income-tax Act, 1961.

3.4 It may be ensured that the reply is furnished within 30 days of the issue of the show cause notice. In case no reply is furnished within 30 days, it shall be presumed that the person responsible for deduction has no cause to state and the matter may be pursued further.

3.5 The AO(TDS) shall examine the reasons/reply for non-compliance and will prepare the proposal in Form ‘F’ (as prescribed in Prosecution Manual) and send it to the CIT(TDS) through proper channel. Separate proposal should be submitted for separate assessment years. The Form ‘F’ will indicate inter alia, the following:

(a) The facts indicating the commission of offence.

(b) Chronology of events, primary & secondary evidences to establish the offence.

(c) Present stage of the proceedings relating to the commission of offence.

(d) List of documentary evidences including depositions, submissions to prove the offence.

(e) List of witnesses on which the departmental case depends.

(f) Any other facts or evidence to establish the offence.

(g) It has to be clearly mentioned in the proposal whether the offence is second or subsequent offence in terms of Section 278A.

An entry can be made by the AO(TDS) in the Form ‘C’ (manual register or the specific module for prosecution as and when developed on TRACES) as soon as the proposal is moved.

3.6 While the AO(TDS) will mandatorily refer all the cases of TDS default exceeding Rs.1 lakh to CIT(TDS), cases of defaults between Rs.25000-Rs.1lakh shall be referred to the CIT(TDS) only if he is satisfied that it is a case fit for prosecution. The report to CIT(TDS) shall be submitted within 60 days of the issue of show cause notice. Time granted to furnish the reply may be excluded from this time limit.

3.7 The CIT(TDS) is the competent authority to accord sanction u/s 279(1). He shall:

a. If he is of the opinion that the case is prima facie fit for prosecution, then, issue show cause notice(s) to all proposed accused(s) u/s 276B/276BB r.w.s. 278B of the I.T. Act as to why sanction for launching of prosecution should not be accorded. The show cause notice can be generated from the online module on TRACES, as and when the facility is made available.

b. He shall after hearing the assessee and after proper application of mind clearly enunciate that while processing the cases for prosecution u/s 276B/276BB r.w.s. 278B, a fair and judicious view has been taken in view of the provisions of Section 278AA before filing the complaint(s). This should get reflected in both the sanction orders passed by the Commissioners/Directors under Section 279(1) and the complaints filed with the competent Courts:

i. There is no statutory requirement for obtaining opinion of the Counsel before granting sanction for prosecution. However, given the fact that TDS offences are technical in nature, such reference could be made in complex situations like identification of accused(s) etc to avoid legal infirmities in prosecution proposals/complaints. In such cases, it should be ensured that the opinion should be obtained from the Counsel within 30 days. If after examining the opinion of the Standing Counsel, he is satisfied that it is a fit case for prosecution, he shall pass a speaking order u/s 279(1) separately for each assessment year.

ii. In case he is not satisfied after receiving reply, he shall drop the proceedings. An entry shall be made by the CIT(TDS) in the prosecution register or in the utility as and when available in TRACES on passing of such orders as mentioned in para (b) above or as soon as the decision to drop proceedings is made. The CIT(TDS) shall complete the process and pass an order u/s 279 sanctioning prosecution or dropping the show cause notice within 60 days of receipt of the proposal.

3.8 The assessee deductor can at any stage of the proceedings, file a compounding application before the Pr. Chief Commissioner of Income-tax/Chief Commissioner of Income-tax. Instruction vide F.No.285/35/2013-IT(Inv.V)/108 dt. 23.12.2014 should be followed in dealing with the compounding applications. If a person who has committed an offence(s) under S.276B/276BB files an application for compounding of the said offence(s), the application should be processed on priority basis and mandatorily be disposed off within the time frame as

prescribed by the Central Action Plan guidelines. During the pendency of the compounding application, the CIT(TDS) shall keep the prosecution proposal pending.

However, if the application is not decided within the prescribed time, the CIT(TDS) shall proceed to file the

complaint. As soon as an application for compounding is moved, an entry should be made in the

prosecution register maintained manually or in the utility as and when available in TRACES. Entries of subsequent action on compounding application shall also be made in such register.

3.9 The CIT(TDS) after according sanction u/s 279(1) shall send back the records to the authority seeking sanction with sanction order in duplicate, one for filing in the Court with complaint and other for the record.

3.10 The AO(TDS) shall, after entering receipt of the sanction order in the prosecution register maintained by him, ensure that the complaint is launched in the competent Court having jurisdiction over the place where the offence is committed.

3.11 The CIT(TDS) & the AO(TDS) shall both make an entry in the respective registers maintained manually or in the utility as and when available in TRACES.

3.12 Similarly, if any such prosecutable offence comes to light during the proceedings before the appellate authorities, revision authorities or any other proceedings, same shall also be treated at par with other prosecutable cases as enumerated under Chapter-XVII of the Income Tax Act, 1961 and action shall be initiated in accordance with procedure as laid vide this SOP.

TIME FRAME :-

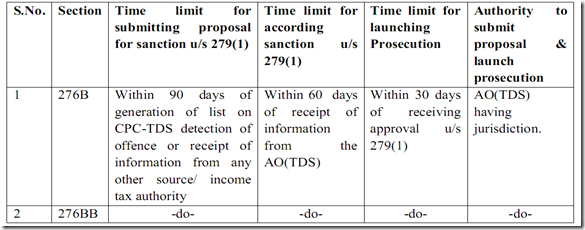

4. The time period for the entire process from identification to passing of order u/s 279(1)/279(2) should be as under:

STANDARD OPERATING PROCEDURE DEFINING THE ROLES OF DIFFERENT TDS AUTHORITIES IN ADDRESSING THE ISSUE OF PROSECUTION AND COMPOUNDING OF TDS CASES

I. Role of Principal CCIT/CCIT(TDS):

(i) Taking quarterly review meeting with CIT(TDS) monitoring progress in all cases identified for prosecution.

(ii) Apprising the Zonal Member of the progress/ outcome made during the month through monthly DO. Copy of such progress shall also be sent to Pr. DGIT(Admn.), New Delhi for information and monitoring.

(iii) Disposing all compounding petitions received expeditiously and within the time period prescribed in the Central Action Plan. While disposing off compounding petitions, speaking orders are expected to contain those facts based on which a fair and judicious view has been taken in accordance with relevant provisions of the

Income Tax Act, 1961.

II. Role of CIT(TDS)

(i) Ensuring that the Guidelines issued vide F.No.285/35/2013-IT(Inv.V)/108 dt.23.12.2014 are adhered to.

(ii) Monitoring the action in the cases of mandatory processing for prosecution generated by the CPC-TDS on a monthly basis.

(iii) Guiding AO(TDS) to shortlist the cases for processing of prosecution on the basis of list-B and identified on the basis information received from external sources such as spot verification/survey and monitoring action thereon.

(iv) Maintaining a register in Form-D or in online utility as and when made available in TRACES wherein record of all cases identified for prosecution should be kept.

(v) Processing all the proposal received by him and if he is of the opinion that the case is prima facie fit for prosecution, issue show cause notices to the accused(s) u/s 276B/276BB r.w.s. 278B or 278C as to why sanction for launching of prosecution should not be accorded.

(vi) Seeking opinion of the Prosecution or Standing Counsel, as the case may be, about suitability of the case for launching of prosecution and as well as strength of the case against accused(s). Ensuring that the opinion is obtained from the Counsel within 30 days.

(vii) Examining the opinion of the Standing Counsel and on satisfaction that it is a fit case for prosecution, passing speaking orders u/s 279(1) in the case of accused(s) for each assessment year separately. In case he is not satisfied, he shall drop the proceedings.

(viii) Completing the process and passing an order u/s 279 sanctioning prosecution or dropping the show cause notice within 60 days of receipt of the proposal.

(ix) Making an entry for the following events in the manual register or in the utilitycreated in TRACES:

a. On receipt of proposal from the AO(TDS).

b. On issue of show cause notice to the accused / co-accused.

c. On passing of sanction order u/s 279(1) or on dropping of the proceedings as the case may be.

d. On receipt of compounding application / report on the compounding application.

e. On filing of complaint / launching of prosecution before the competent court.

f. On receipt of order of competent Court

g. On appeal, if any appeal is filed.

III. Role of Addl.CIT(TDS)

(i) Discussing cases of list-B generated by CPC-TDS and list prepared on the basis of information received from external sources such as spot verification/survey with AO(TDS) and also guiding them in short listing the cases fit for prosecution.

(ii) Monitoring timely action in all the cases involving mandatory processing for prosecution or cases identified otherwise and to report the progress to the CIT (TDS) in the monthly DO.

IV. Role of AO(TDS)

(i) Downloading list of cases identified by CPC-TDS for mandatory proceeding ofcases (list-A).

(ii) Downloading list-B of cases for identification of cases based on facts and circumstances of the cases and also to examine cases on the basis of information gathered from external sources such as spot verification / surveys and shortlist cases fit for prosecution amongst these cases after discussion with Range Head and CIT(TDS).

(iii) Initiating action and collecting information in accordance with the procedures laid down above.

(iv) Issuing show cause notice to all the accused(s) identified by him giving due opportunity to the accused within 45 days of receipt of the list of prosecutable cases from CPC-TDS.

(v) Sending the proposal prepared in Form ‘F’ alongwith other information / documents to the CIT(TDS) through proper channel.

(vi) Making an entry for the following events in the manual register or as and whenin the utility made available in TRACES:

a. Initiation of proceedings for prosecution.

b. Sending the proposal to the CIT(TDS) for necessary action.

c. Date of receipt of sanction u/s 279(1) of CIT(TDS).

d. Filing of complaint / launching of prosecution in the competent court on receiving order u/s 279(1).

e. In case report on the compounding application is to be sent on filing of compounding application by the deductor, date of the report as well as when order on such application is received from the competent authority.

f. On receiving orders of the competent Court in the case, date of filing of appeal, if any filed.

V. Role of CIT(CPC-TDS), Ghaziabad:

(i) Generating list-A of defaulters along with their statement of defaults for mandatory processing of cases for prosecution involving delayed payment of Rs. 1 lakhs or more as prescribed in the present Instruction and make it available to AO(TDS) as well as the CIT(TDS) within one month of the filing of the quarterly TDS statement.

(ii) Generating list-B of cases involving defaults of delay in payment of Rs.25,000/- to 1,00,000/- alongwith default sheets for the year as well as proceeding year and subsequent year (if dates are available), to help CIT(TDS) AO(TDS) to identify cases fit for prosecution based on facts & circumstances of the cases within one month of the filing of the quarterly TDS statement.

(iii) Generating a list of non-filers of TDS statement within one month of the due date and communicating to the AO(TDS) with a copy to the CIT(TDS).

(iv) Developing and maintaining a specific module/utility in TRACES for identification and control over prosecution proceedings where all the details of each case of prosecution can be maintained online. Related TagsCBDT, Incometax