The next time you organise a grand function, be ready to face the taxman. The Central Board of Excise & Customs (CBEC) has directed its officers to check for tax evasion by keeping an eye on events which receive wide media coverage, such as an ostentatious wedding or other such functions.

Usually, the service provider pays the tax and recovers the amount from the recipient. So, if somebody hires an event manager for a function, the service receiver should pay tax to the service provider, along with the payment of his fee. Even services such as setting up pandals and shamianas are taxable.

“The tax department is perfectly capable of disrupting the wedding. They will keep a tab on the event manager and approach him at the most opportune moment to make him pay the past dues,” said a tax expert with a leading consultancy firm, asking not to be named.

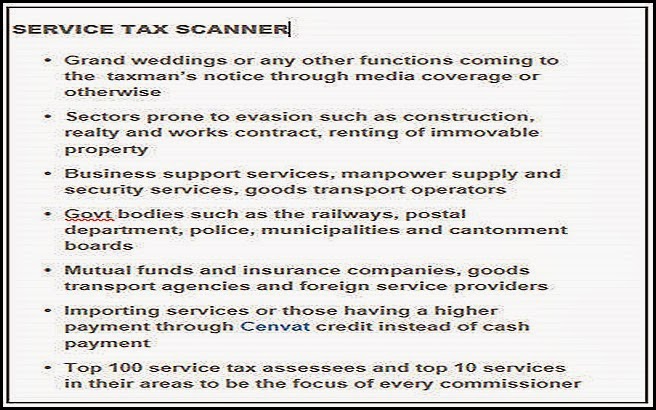

Taking a cue from declarations made in the amnesty scheme for service tax last year, it also identified construction, real estate and work contracts, renting of immovable property, business support services, personnel supply and security services, and goods transport operators as sectors prone to evasion.

Souce:- BS Related Tags Servicetax