Annual Information Statement (AIS) is much more comprehensive than Form 26AS. While Form 26AS was reflection of transaction on which TDS / TCS was applicable, AIS shall reflect all transactions even if TDS / TCS was not applicable or transaction Value is Below threshold limit.

You would be aware that recently Income Tax Department has rolled out the new Annual Information Statement (AIS) on the Compliance Portal which provides a comprehensive view of information to a taxpayer with a facility to capture online feedback.

How to Login to Annual Information Statement?

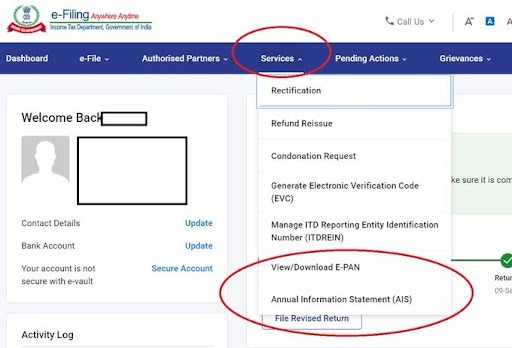

Simply Log in to Income Tax Efiling Portal and on the home page under services tab you can see a Annual Information Statement Link. Currently only for FY 2020-21 has been activated.

What is AIS?

The AIS is a comprehensive statement containing details of financial transactions done by you and reported by various entities (mostly financial institutions) to the tax department during an FY.

This includes receipt/income from different sources such as salary, interest etc. or sale or purchase of securities such as equity shares, mutual funds, bonds etc. For instance, any sale or purchase of shares or mutual fund units or dividend or interest received will be reflected in the AIS.

Structure of AIS

AIS is divided into two parts: Part A and Part B. Part A contains general information such as PAN, masked Aadhaar number, name of taxpayer, date of birth etc. Part B contains comprehensive information of TDS, TCS, Specified financial transactions, payment of taxes, tax demand and refund and other information.

You will be able to download AIS information in PDF, JSON, CSV formats, the tax department stated in a press release.

Along with AIS, the income tax department also introduced the Taxpayer Information Summary (TIS). This is a simplified way of viewing the information from the AIS. As per the income tax department press release, “TIS shows the processed value (i.e. the value generated after deduplication of information based on pre-defined rules) and derived value (i.e. the value derived after considering the taxpayer feedback and processed value). If the taxpayer submits feedback on AIS, the derived information in TIS will be automatically updated in real-time. The derived information in TIS will be used for pre-filling of Return (pre-filling will be enabled in a phased manner).”

Corrections in AIS

Thus, if you discover any error in your TIS or AIS, then you need to get it corrected in the AIS, which will be simultaneously corrected in TIS as well in real-time. It is important to check the AIS and give your feedback. In case there is an error and you have not given feedback requesting correction, then it may be assumed that the information reflecting in AIS is correct and the income tax department may ask you to explain the mismatch between the income tax return filed by you and the information in the AIS.

“If the taxpayer feels that the information is incorrect, relates to other person/year, duplicate etc., a facility has been provided to submit online feedback. Feedback can also be furnished by submitting information in bulk,” the press release stated.

Key Takeaways from above

A) More Comprehensive Information vis a vis 26AS

B) You Can Download PDF / JSON / CSV

C) You Can Apply for submitted feedback on incorrect information

How AIS is different from Form 26AS

Form 26AS is like a tax passbook which contains details of TDS and TCS deposited against the taxpayer’s PAN during the financial year. Further, in the amended version of Form 26AS, the information related to specified transactions such as mutual fund unit purchases, foreign remittances etc. will be reflected only if the transaction exceeds the specified limit or where tax has been deducted. For instance, if tax has been deducted on the interest received on a fixed deposit, then it will be reflected in Form 26AS.

AIS is more comprehensive. In case of AIS, the transactions will be reflected irrespective of whether tax has been deducted or not. So, even if tax has not been deducted on the interest received on a fixed deposit, it will still be shown in the AIS. The statement will reflect TDS, TCS, sale, purchase of equity shares, mutual funds, dividend, interest income etc. There is no specified limit for transactions to be featured in the AIS. Thus, even if you invest Rs 2,000 in a mutual fund SIP it will be reflected in your AIS. Essentially, AIS reflects all the small and big specified financial transactions done by you which have been reported by various financial entities to the income tax department.

Such reporting is compliance required of these entities by law. Therefore, AIS shows all the financial transactions done by you that the income tax department knows about.

Author’s View

On Exploring the AIS you will realize that All Groups of Income / Remittance necessary for your Correct ITR Filing are duly mentioned with respective details like – Salary, Business Receipts, Dividend, Interest Income, Sale of Securities, Purchase of Securities, Interest from Savings A/c’s, Outward Remittance / Inward remittance.

Now I Think that one must also understand that ITR Notices will be issued based on more Comprehensive AIS and not 26AS since Department has now more Information about you than anytime ever before. Assessees must cautiously analyze all information in their AIS and only then File their Income tax Return.

Download Press release of Income Tax on 01/11/2021

FCA, CWM (AAFM-US), CBV, CIFRS, R-ID, B.COM (H), RV* (IBBI)

Practising Chartered Accountant in Delhi NCR Since 2011. He can be contacted at ankitgulgulia@gmail.com or +91-9811653975.