Section 206AA vs. The DTAA: The Supreme Court Finally Settles the “20% TDS” Conflict

By CA Ankit Gulgulia (Jain)

On one hand, the Double Taxation Avoidance Agreements (DTAA) promised a lower withholding rate (usually 10% for Royalties/FTS). On the other, Section 206AA of the Income Tax Act, 1961, wielded a blunt instrument: “No PAN? Deduct at 20%.”

The Revenue has long argued that the non-obstante clause in Section 206AA overrides the Treaty.

In a landmark development, the Supreme Court of India has put this controversy to rest. Affirming the principles laid down by various High Courts (most notably the Delhi High Court in Danisco India), the Apex Court has clarified that Treaty benefits cannot be denied simply due to the absence of a PAN.

Let’s decode the technical jurisprudence behind this ruling and what it means for your Form 15CA/CB filings.

1. The Statutory Conflict: A Battle of Non-Obstante Clauses

To understand the gravity of this ruling, we must look at the intersecting sections of the Income Tax Act, 1961:

- Section 90(2): The “Magna Carta” of international tax in India. It states that where a DTAA exists, the provisions of the Act shall apply only to the extent they are more beneficial to the assessee.

- Section 206AA (Introduced in 2010): Stipulates that if a deductee fails to furnish a Permanent Account Number (PAN), TDS must be deducted at the higher of:

- Rate in the Act

- Rate in force (Treaty rate)

- 20%

The Revenue’s Argument: Section 206AA begins with “Notwithstanding anything contained in any other provisions of this Act…” The Revenue interpreted this to mean Section 206AA overrides Section 90(2).

The Supreme Court’s Clarification:

The Court has essentially upheld the doctrine of Pacta Sunt Servanda (agreements must be kept). A domestic machinery provision (Section 206AA) cannot override a substantive sovereign guarantee (the DTAA).

The Hierarchy of Law:

2. Why “Rule 37BC” Wasn’t Enough

Many of you might ask, “Didn’t Rule 37BC already fix this?”

Yes and No.

Rule 37BC (introduced in 2016) allowed non-residents to avoid the 20% rate without a PAN if they provided alternative documents (Tax Residency Certificate, Tax ID, Address).

However, Rule 37BC had limitations:

- Applicability: It only covered Interest, Royalty, FTS, and Dividend. It left out other payments.

- Retrospectivity: Disputes for years prior to 2016 were still being litigated.

- Strict Compliance: If a vendor made a minor error in furnishing the alternative documents, AOs would immediately revert to Section 206AA.

The SC Judgment Effect:

This ruling goes beyond Rule 37BC. It establishes a fundamental legal principle: The inability to obtain a PAN is not a ground to deny Treaty rates. Even if Rule 37BC didn’t exist, the DTAA rate would still prevail over Section 206AA.

3. The P&L Impact: “Grossing Up” Savings (Section 195A)

For Indian companies with “Net of Tax” contracts (where the Indian payer bears the TDS), this is a massive cash-flow relief.

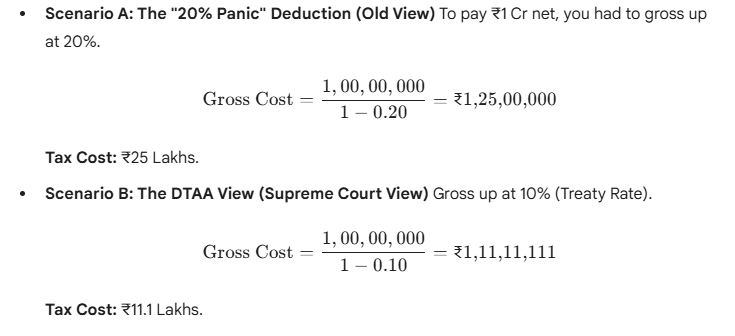

Consider a Royalty payment of ₹1 Crore to a US Entity (Treaty Rate 10% vs. Sec 206AA 20%).

The Bottom Line: The Supreme Court just saved the Indian payer ₹13.9 Lakhs on a ₹1 Cr remittance.

4. Documentation: The “TRC” is now King

While the PAN requirement is gone, the burden of proof has not vanished. It has shifted entirely to the Tax Residency Certificate (TRC).

To claim the lower rate (10%) without PAN, you must ensure your documentation rigor is absolute to satisfy Section 90(4) and Section 90(5):

- Valid TRC: Must be for the relevant financial year.

- Form 10F: Since the non-resident doesn’t have a PAN, they cannot file Form 10F electronically on the Indian portal (a current tech glitch). However, a manual Form 10F signed by the vendor is mandatory to substantiate the TRC.

- No PE Declaration: A robust declaration stating the vendor has no Permanent Establishment (PE) in India is crucial, as DTAA benefits for Royalty/FTS disappear if the income is effectively connected to a PE.

5. Summary & Actionable Advice

This judgment is a victory for the Ease of Doing Business and upholds the sanctity of International Law over domestic procedural hurdles.

Checklist for Finance Heads:

- Review Past Disputes: If you have pending appeals where 206AA was invoked for lack of PAN, file a submission citing this SC ruling immediately.

- Update Vendor Masters: You no longer need to force foreign vendors to apply for an Indian PAN (a process they detest).

- Reinforce TRC Collection: Ensure your accounts payable team does not release payment until the TRC and Form 10F are on file. Without PAN, these two documents are your only shield.

The final verdict: Section 206AA is a paper tiger when a valid DTAA stands in its way.

Case Details :-

Commissioner of Income Tax vs. Mphasis Ltd. & Ors.

- Order Date: November 25, 2025 (As per recent reports)

- Context: In this cluster of appeals, the Supreme Court dismissed the Special Leave Petitions (SLPs) filed by the Income Tax Department against the orders of the Karnataka High Court (and others, including the Wipro and Manthan Software Services cases).

Significance of the November 2025 Ruling 🚀

This most recent ruling is critical because it:

- Affirms Precedents: It cements the January 2023 SC ruling in Air India Ltd. (which affirmed the Delhi HC view) and the line of judgments from the Karnataka High Court (including the Wipro line of cases).

- Broader Scope: It applies the principle to a wide range of cross-border services, including technical and software support fees, confirming the principle is universal across various DTAAs.

- Finality in the South: It specifically provides finality to numerous cases from the Southern benches (Karnataka, etc.) which had followed the Delhi High Court’s view.

FCA, CWM (AAFM-US), CBV, CIFRS, R-ID, B.COM (H), RV* (IBBI)

Practising Chartered Accountant in Delhi NCR Since 2011. He can be contacted at ankitgulgulia@gmail.com or +91-9811653975.