Summary of 76 Amendments in Income Tax by Budget 2021

The provisions of Finance Bill, 2021 (hereafter referred to as “the Bill”), relating to direct taxes seek to amend the Income-tax Act, 1961 (hereafter referred to as ‘the Act’), Prohibition of Benami Property Transactions Act, 1988 (hereafter referred to as ―PBPT Act‖), Finance (No 2) Act, 2004 and Finance Act, 2016 and the Direct Tax Vivad se Vishwas Act, 2020 to continue reforms in direct tax system through tax-incentives, removing difficulties faced by taxpayers and rationalization of various provisions.

Recommended Read :- Changes in GST by Budget 2021

Snapshots

With a view to achieving the above, the various proposals for amendments are organized under the following heads:—

- Rates of income-tax;

- Tax incentives;

- Removing difficulties faced by taxpayers;

- Rationalisation of various provisions.

DIRECT TAXES

A. RATES OF INCOME-TAX

I. Rates of income-tax in respect of income liable to tax for the assessment year 2021-22.

In respect of income of all categories of assessee liable to tax for the assessment year 2021-22, the rates of income-tax have either been specified in specific sections (like section 115BAA or section 115BAB for domestic companies, 115BAC for individual/HUF and 115BAD for cooperative societies) or have been specified in Part I of the First Schedule to the Bill. There is no change proposed in tax rates either in these specific sections or in the First Schedule. The rates provided in sections 115BAA or 115BAB or 115BAC or 115BAD for the

1

assessment year 2021-22 would be same as already enacted. Similarly rates laid down in Part III of the First Schedule to the Finance Act, 2020, for the purposes of computation of ―advance tax‖, deduction of tax at source from ―Salaries‖ and charging of tax payable in certain cases for the assessment year 2021-22 would now become part I of the first schedule. Part III would now apply for the assessment year 2022-23 and would remain unchanged except that it would also apply to proposed section 194P.

(1) Tax rates under section 115BAC and section 115BAD—

From the assessment year 2021-22 (FY 2020-21), individual and HUF tax payers have an option to opt for taxation under section 115BAC of the Act and the resident co-operative society has an option to opt for taxation under the newly inserted section 115BAD of the Act.

On satisfaction of certain conditions as per the provisions of section 115BAC, an individual or HUF shall, from assessment year 2021-22 onwards, have the option to pay tax in respect of the total income at following rates:

| Total Income (Rs) | Rate |

| Upto 2,50,000 | Nil |

| From 2,50,001 to 5,00,000 | 5 per cent. |

| From 5,00,001 to 7,50,000 | 10 per cent. |

| From 7,50,001 to 10,00,000 | 15 per cent. |

| From 10,00,001 to 12,50,000 | 20 per cent. |

| From 12,50,001 to 15,00,000 | 25 per cent. |

| Above 15,00,000 | 30 per cent. |

Similarly, a co-operative society resident in India shall have the option to pay tax at 22 per cent for assessment year 2021-22 onwards as per the provisions of section 115BAD, subject to fulfilment of certain conditions.

(2) Tax rates under Part I of the first schedule applicable for the assessment year 2021-22

A. Individual, HUF, association of persons, body of individuals, artificial juridical person.

Paragraph A of Part-I of First Schedule to the Bill provides following rates of income-tax:—

- The rates of income-tax in the case of every individual (other than those mentioned in (ii) and (iii) below) or HUF or every association of persons or body of individuals, whether incorporated or not, or every artificial juridical person referred to in sub-clause (vii) of clause (31) of section 2 of the Act (not being a case to which any other Paragraph of Part III applies) are as under:—

| Up to Rs. 2,50,000 | Nil. |

| Rs. 2,50,001 to Rs.5,00,000 | 5 percent. |

| Rs. 5,00,001 to Rs.10,00,000 | 20 percent. |

| Above Rs. 10,00,000 | 30 percent. |

- In the case of every individual, being a resident in India, who is of the age of sixty years or more but less than eighty years at any time during the previous year,—

| Up to Rs. 3,00,000 | Nil. |

| Rs. 3,00,001 to Rs.5,00,000 | 5 percent. |

| Rs. 5,00,001 to Rs.10,00,000 | 20 percent. |

| Above Rs. 10,00,000 | 30 percent. |

- in the case of every individual, being a resident in India, who is of the age of eighty years or more at any time during the previous year,—

Up to Rs.5,00,000 Nil.

Rs. 5,00,001 to Rs.10,00,000 20 percent.

Above Rs 10,00,000 30 percent.

b. Co-operativeSocieties

In the case of co-operative societies, the rates of income-tax have been specified in Paragraph B of Part I of the First Schedule to the Bill. They remain unchanged at (10% up to Rs 10,000; 20% between Rs 10,000 and Rs 20,000; and 30% in excess of Rs 30,000)

c. Firms

In the case of firms, the rate of income-tax has been specified in Paragraph C of Part I of the First Schedule to the Bill. They remain unchanged at 30%

d. Local authorities

The rate of income-tax in the case of every local authority has been specified in Paragraph D of Part I of the First Schedule to the Bill. They remain unchanged at 30%.

e. Companies

The rates of income-tax in the case of companies have been specified in Paragraph E of Part I of the First Schedule to the Bill. In case of domestic company, the rate of income-tax shall be twenty five per cent. of the total income, if the total turnover or gross receipts of the previous year 2018-19 does not exceed four hundred crore rupees and in all other cases the rate of Income-tax shall be thirty per cent. of the total income.

In the case of company other than domestic company, the rates of tax are the same as those specified for the FY 2019-20.

(3) Surcharge on income-tax

The amount of income-tax shall be increased by a surcharge for the purposes of the Union,—

(a) in the case of every individual or HUF or association of persons or body of individuals, whether incorporated or not, or every artificial juridical person referred to in sub-clause (vii) of clause (31) of section 2 of the Act, including an individual or HUF exercising option under section 115BAC, not having any income under section 115AD of the Act,—

- having a total income (including the income by way of dividend or income under the provisions of section 111A and 112A of the Act) exceeding fifty lakh rupees but not exceeding one crore rupees, at the rate of ten per cent. of such income- tax; and

- having a total income (including the income by way of dividend or income under the provisions of section 111A and 112A of the Act) exceeding one crore rupees but not exceeding two crore rupees, at the rate of fifteen per cent. of such income-tax;

- having a total income (excluding the income by way of dividend or income under the provisions of section 111A and 112A of the Act) exceeding two crore rupees but not exceeding five crore rupees, at the rate of twenty-five per cent. of such income-tax;

- having a total income (excluding the income by way of dividend or income under the provisions of section 111A and 112A of the Act) exceeding five crore rupees, at the rate of thirty-seven per cent. of such income-tax;

- having a total income (including the income by way of dividend or income under the provisions of section 111A and 112A of the Act) exceeding two crore rupees, but is not covered under clause (iii) or (iv) above, at the rate of fifteen per cent of such incometax:

Provided that in case where the total income includes any income by way of dividend or income chargeable under section 111A and 112A of the Act, the rate of surcharge on the amount of income-tax computed in respect of that part of income shall not exceed fifteen percent;

However, surcharge shall be at the rates provided in (i) to (v) above for all category of income without excluding dividend or capital gains in case if the income is taxable under section 115A, 115AB, 115AC, 115ACA and 115E.

(aa) in the case of individual or every association of person or body of individuals, whether incorporated or not, or every artificial juridical person referred to in sub-clause (vii) of clause (31) of section 2 of the Income-tax

Act having income under section 115AD of the Act,-

- having a total income exceeding fifty lakh rupees but not exceeding one crore rupees, at the rate of ten per cent of such income-tax; and

- having a total income exceeding one crore rupees but not exceeding two crore rupees, at the rate of fifteen per cent of suchincome-tax;

- having a total income [excluding the income by way of dividend or income of the nature referred to in clause (b) of sub-section (1) of section 115AD of the Act] exceeding two crore rupees but not exceeding five crore rupees, at the rate of twenty-five per cent. of suchincome-tax;

- having a total income [excluding the income by way of dividend or income of the nature referred to in clause (b) of sub-section (1) of section 115AD of the Act] exceeding five crore rupees, at the rate of thirty-seven per cent. of such income-tax;

- having a total income [including the income by way of dividend or income of the nature referred to in clause (b) of sub-section (1) of section 115AD of the Act] exceeding two crore rupees but is not covered in sub-clauses (iii) and (iv), at the rate of fifteen per cent. of suchincome-tax:

Provided that in case where the total income includes any income by way of dividend or income chargeable under clause (b) of sub-section (1) of section 115AD of the Act, the rate of surcharge on the income-tax calculated on that part of income shall not exceed fifteen percent;

- in the case of every co-operative society (except resident co-operative society opting under section 115BAD) or firm or local authority, at the rate of twelve per cent of such income-tax, where the total income exceeds one crore rupees;

- In case of resident co-operative society opting under section 115BAD, at the rate of ten percent of such income tax.

- in the case of every domestic company, except such domestic company whose income is chargeable to tax under section 115BAA or section 115BAB of the Act,—

- at the rate of seven per cent. of such income-tax, where the total income exceeds one crore rupees but does not exceed ten crorerupees;

- at the rate of twelve per cent. of such income-tax, where the total income exceeds ten crore rupees;

- in the case of domestic company whose income is chargeable to tax under section 115BAA or 115BAB of the Act, at the rate of ten percent; (f) in the case of every company, other than a domestic company,—

- at the rate of two per cent. of such income-tax, where the total income exceeds one crore rupees but does not exceed ten crorerupees;

- at the rate of five per cent. of such income-tax, where the total income exceeds ten crorerupees;

(g) In other cases (including sections 92CE, 115-O, 115QA, 115R, 115TA or 115TD), the surcharge shall be levied at the rate of twelve percent.

(4) Marginal Relief—

Marginal relief has also been provided in all cases where surcharge is proposed to be imposed.

(5) Education Cess—

For assessment year 2021-22, ―Health and Education Cess‖ is to be levied at the rate of four per cent. on the amount of income tax so computed, inclusive of surcharge wherever applicable, in all cases. No marginal relief shall be available in respect of such cess.

II. Rates for deduction of income-tax at source during the financial year (FY) 2021-22 from certain incomes other than“Salaries”.

The rates for deduction of income-tax at source during the FY 2021-22 under the provisions of section 193, 194A, 194B, 194BB, 194D, 194LBA, 194LBB, 194LBC and 195 have been specified in Part II of the First Schedule to the Bill. The rates will remain the same as those specified in Part II of the First Schedule to the Finance Act, 2020, for the purposes of deduction of income-tax at source during the FY 2020-21. For sections specifying the rate of deduction of tax at source, the tax shall continue to be deducted as per the provisions of these sections.

Surcharge—

The amount of tax so deducted shall be increased by a surcharge,—

- in the case of every individual or HUF or association of persons or body of individuals, whether incorporated or not, or every artificial juridical person referred to in sub-clause (vii) of clause (31) of section 2 of the Act, being a non-resident, calculated,—

- at the rate of ten per cent. of such tax, where the income or aggregate of income (including the income by way of dividend or income under the provisions of sections 111A and 112A of the Act) paid or likely to be paid and subject to the deduction exceeds fifty lakh rupees but does not exceed one crore rupees;

- at the rate of fifteen per cent. of such tax, where the income or aggregate of income (including the income by way of dividend or income under the provisions of sections 111A and 112A of the Act)paid or likely to be paid and subject to the deduction exceeds one crore rupees but does not exceed two crore rupees;

- at the rate of twenty-five per cent. of such tax, where the income or aggregate of income (excluding the income by way of dividend or income under the provisions of sections 111A and 112A of the Act) paid or likely to be paid and subject to the deduction exceeds two crore rupees but does not exceed five crore rupees;

- at the rate of thirty-seven per cent. of such tax, where the income or aggregate of income (excluding the income by way of dividend or income under the provisions of sections 111A and 112A of the Act) paid or likely to be paid and subject to the deduction exceeds five

crore rupees;

- at the rate of fifteen per cent. Of such tax, where the income or aggregate of income (including the income by way of dividend or income under the provisions of section 111A and 112A of the Act) paid or likely to be paid and subject to the deduction exceeds two crore rupees, but is not covered under (iii) and (iv) above provided that in case where the total income includes any income by way of dividend of income chargeable under section 111A and section 112A of the Act, the rate of surcharge on the amount of income-tax deducted in respect of that part of income shall not exceed fifteen per cent.

- in the case of every co-operative society or firm, being a non-resident, calculated at the rate of twelve per cent. of such tax, where the income or the aggregate of such incomes paid or likely to be paid and subject to the deduction exceeds one crorerupees;

- in the case of every company, other than a domestic company, calculated,—

- at the rate of two per cent. of such tax, where the income or the aggregate of such incomes paid or likely to be paid and subject to the deduction exceeds one crore rupees but does not exceed ten crorerupees;

- at the rate of five per cent. of such tax, where the income or the aggregate of such incomes paid or likely to be paid and subject to the deduction exceeds ten crorerupees.

No surcharge will be levied on deductions in other cases.

(2) Education Cess—

―Health and Education Cess‖ shall continue to be levied at the rate of four per cent. of income tax including surcharge wherever applicable, in the cases of persons not resident in India including company other than a domestic company.

III. Rates for deduction of income-tax at source from “Salaries”, computation of “advance tax” and charging of income-tax in special cases during the FY2021-22.

The rates for deduction of income-tax at source from ―Salaries‖ or under section 194P of the Act during the FY 2021-22 and also for computation of ―advance tax‖ payable during the said year in the case of all categories of assessee have been specified in Part III of the First Schedule to the Bill. These rates are also applicable for charging income-tax during the FY 2021-22 on current incomes in cases where accelerated assessments have to be made, for instance, provisional assessment of shipping profits arising in India to non-residents, assessment of persons leaving India for good during the financial year, assessment of persons who are likely to transfer property to avoid tax, assessment of bodies formed for a short duration, etc. There is no change in the tax rates from last year. The salient features of the rates specified in the said Part III are indicated in the following paragraphs-

A. Individual, HUF, association of persons, body of individuals, artificial juridicalperson.

Paragraph A of Part-III of First Schedule to the Bill provides following rates of income-tax:—

- The rates of income-tax in the case of every individual (other than those mentioned in (ii) and (iii) below) or HUF or every association of persons or body of individuals, whether incorporated or not, or every artificial juridical person referred to in sub-clause (vii) of clause (31) of section 2 of the Act (not being a case to which any other Paragraph of Part III applies) are as under:—

| UptoRs.2,50,000 | Nil. |

| Rs. 2,50,001 to Rs.5,00,000 | 5 percent. |

| Rs. 5,00,001 to Rs.10,00,000 | 20 percent. |

| AboveRs10,00,000 | 30 percent. |

- In the case of every individual, being a resident in India, who is of the age of sixty years or more but less than eighty years at any time during the previousyear,—

| UptoRs.3,00,000 | Nil. |

| Rs. 3,00,001 to Rs.5,00,000 | 5 percent. |

| Rs. 5,00,001 to Rs.10,00,000 | 20 percent. |

| AboveRs10,00,000 | 30 percent. |

- in the case of every individual, being a resident in India, who is of the age of eighty years or more at any time during the previousyear,—

UptoRs.5,00,000 Nil.

Rs. 5,00,001 to Rs.10,00,000 20 percent.

AboveRs10,00,000 30 percent.

The amount of income-tax computed in accordance with the preceding provisions of this Paragraph (including capital gains under section 111A, 112 and 112A) as well as income tax computed under section 115BAC, shall be increased by a surcharge at the rateof,—

- having a total income (including the income by way of dividend or income under the provisions of sections 111A and 112A of the Act) exceeding fifty lakh rupees but not exceeding one crore rupees, at the rate of ten per cent. of such income-tax;

- having a total income (including the income by way of dividend or income under the provisions of sections 111A and 112A of the Act) exceeding one crore rupees, at the rate of fifteen per cent. of such income-tax;

- having a total income (excluding the income by way of dividend or income under the provisions of sections 111A and 112A of the Act) exceeding two crore rupees but not exceeding five crore rupees, at the rate of twenty-five per cent. of such income-tax;

- having a total income (excluding the income by way of dividend or income under the provisions of sections 111A and 112A of the Act) exceeding five crore rupees, at the rate of thirty-seven per cent. of such income-tax;

- having a total income (including the income by way of dividend or income under the provisions of section 111A and section 112A of the Act) exceeding two crore rupees, but is not covered under clauses (c) and (d), shall be applicable at the rate of fifteen per cent. of such income-tax:

Provided that in case where the total income includes any income by way of dividend or income chargeable under section 111A and section 112A of the Act, the rate of surcharge on the amount of Income-tax computed in respect of that part of income shall not exceed fifteen percent..

Marginal relief is provided in cases of surcharge.

On satisfaction of certain conditions as per the provisions of section 115BAC, an individual or HUF shall, from assessment year 2021-22 onwards, have the option to pay tax in respect of the total income at following rates:

| Total Income (Rs) | Rate |

| Upto 2,50,000 | Nil |

| From 2,50,001 to 5,00,000 | 5 per cent. |

| From 5,00,001 to 7,50,000 | 10 per cent. |

| From 7,50,001 to 10,00,000 | 15 per cent. |

| From 10,00,001 to 12,50,000 | 20 per cent. |

| From 12,50,001 to 15,00,000 | 25 per cent. |

| Above 15,00,000 | 30 per cent. |

B. Co-operativeSocieties

In the case of co-operative societies, the rates of income-tax have been specified in Paragraph B of Part III of the First Schedule to the Bill. These rates will continue to be the same as those specified for FY 2020-21. The amount of income-tax shall be increased by a surcharge at the rate of twelve per cent. of such income-tax in case of a co-operative society having a total income exceeding one crore rupees. However, the total amount payable as income-tax and surcharge on total income exceeding one crore rupees shall not exceed the total amount payable as income-tax on a total income of one crore rupees by more than the amount of income that exceeds one crore rupees.

On satisfaction of certain conditions, a co-operative society resident in India shall have the option to pay tax at 22 per cent for assessment year 2021-22 onwards as per the provisions of section 115BAD. Surcharge would be at 10% on such tax.

C. Firms

In the case of firms, the rate of income-tax has been specified in Paragraph C of Part III of the First Schedule to the Bill. This rate will continue to be the same as that specified for FY 2020-21. The amount of income-tax shall be increased by a surcharge at the rate of twelve per cent. of such income-tax in case of a firm having a total income exceeding one crore rupees. However, the total amount payable as income-tax and surcharge on total income exceeding one crore rupees shall not exceed the total amount payable as income-tax on a total income of one crore rupees by more than the amount of income that exceeds one crore rupees.

D. Local authorities

The rate of income-tax in the case of every local authority has been specified in Paragraph D of Part III of the First Schedule to the Bill. This rate will continue to be the same as that specified for the FY 2020-21. The amount of income-tax shall be increased by a surcharge at the rate of twelve per cent. of such income-tax in case of a local authority having a total income exceeding one crore rupees. However, the total amount payable as income-tax and surcharge on total income exceeding one crore rupees shall not exceed the total amount payable as income-tax on a total income of one crore rupees by more than the amount of income that exceeds one crore rupees.

E. Companies

The rates of income-tax in the case of companies have been specified in Paragraph E of Part III of the First Schedule to the Bill. In case of domestic company, the rate of income-tax shall be twenty five per cent. of the total income, if the total turnover or gross receipts of the previous year 2019-20 does not exceed four hundred crore rupees and in all other cases the rate of Income-tax shall be thirty per cent. of the total income. However, domestic companies also have an option to opt for taxation under section 115BAA or section 115BAB of the Act on fulfillment of conditions contained therein. The tax rate is 15 per cent. in section 115BAB and 22 per cent. in section 115BAA. Surcharge is 10 per cent. in both cases.

In the case of company other than domestic company, the rates of tax are the same as those specified for the FY 2020-21.

Surcharge at the rate of seven per cent. shall continue to be levied in case of a domestic company (except those opting for taxation under section 115BAA and section 115BAB of the Act), if the total income of the domestic company exceeds one crore rupees but does not exceed ten crore rupees. Surcharge at the rate of twelve per cent shall continue to be levied, if the total income of the domestic company (except those opting for taxation under section 115BAA and section 115BAB of the Act) exceeds ten crore rupees.

In case of companies other than domestic companies, the existing surcharge of two per cent shall continue to be levied, if the total income exceeds one crore rupees but does not exceed ten crore rupees. Surcharge at the rate of five per cent shall continue to be levied, if the total income of the company other than domestic company exceeds ten crore rupees.

Marginal relief is provided in surcharge in all cases.

In other cases [including sub-section (2A) of section 92CE, sections 115-O, 115QA, 115R, 115TA or 115TD], the surcharge shall be levied at the rate of twelve per cent.

For FY 2021-22, additional surcharge called the ―Health and Education Cess on income-tax‖ shall be levied at the rate of four per cent on the amount of tax computed, inclusive of surcharge (wherever applicable), in all cases. No marginal relief shall be available in respect of such cess.

[Clause 2 & the First Schedule]Tax Incentives

Exemption for LTC Cash Scheme

Under the existing provisions of the Act, clause (5) of section 10 of the Act provides for exemption in respect of the value of travel concession or assistance received by or due to an employee from his employer or former employer for himself and his family, in connection with his proceeding on leave to any place in India. In view of the situation arising out of outbreak of COVID pandemic, it is proposed to provide tax exemption to cash allowance in lieu of LTC.

Hence, it is proposed to insert second proviso in clause 5 of section 10, so as to provide that, for the assessment year beginning on the 1st day of April, 2021, the value in lieu of any travel concession or assistance received by, or due to, an individual shall also be exempt under this clause subject to fulfilment of conditions to be prescribed. It is also proposed to clarify by way of an Explanation that where an individual claims and is allowed exemption under the second proviso in connection with prescribed expenditure, no exemption shall be allowed under this clause in respect of same prescribed expenditure to any other individual.

The conditions for this purpose shall be prescribed in the Income-tax Rules in due course and shall, inter alia, be as under:

- The employee exercises an option for the deemed LTC fare in lieu of the applicable LTC in the Block year 2018-21;

- ―specified expenditure‖ means expenditure incurred by an individual or a member of his family during the specified period on goods or services which are liable to tax at an aggregate rate of twelve per cent or above under various GST laws and goods are purchased or services procured from GST registered vendors/service providers;

- ―specified period‖ means the period commencing from 12th day of October,

2020 and ending on 31st day of March, 2021;

- the amount of exemption shall not exceed thirty-six thousand rupees per person or one-third of specified expenditure, whichever is less;

- the payment to GST registered vendor/service provider is made by an account payee cheque drawn on a bank or account payee bank draft, or use of electronic clearing system through a bank account or through such other electronic mode as prescribed under Rule 6ABBA and tax invoice is obtained from such vendor/service provider;

- If the amount received by, or due to an individual as per the terms of his employment, from his employer in relation to himself and his family, for the LTC is more than what is allowable to such person under the above discussed provisions, the exemption under the proposed amendment would be available only to the extent of exemption admissible under above listed provisions.

This amendment will take effect from 1st April, 2021 and will, apply in relation to the assessment year 2021-2022 only.

[Clause 5] Incentives for affordable rental housing

The existing provision of the section 80-IBA of the Act provides that where the gross total income of an assessee includes any profits and gains derived from the business of developing and building affordable housing project, there shall, subject to certain conditions specified therein, be allowed a deduction of an amount equal to hundred per cent. of the profits and gains derived from such business. One of the conditions is that the project is approved by the competent authority after the 1st day of June 2016 but on or before the 31st day of March 2021.

To help migrant labourers and to promote affordable rental, it is proposed to allow deduction under section 80-IBA of the Act also to such rental housing project which is notified by the Central Government in the Official Gazette and fulfils such conditions as specified in the said notification.

Further, it is also proposed that the outer time limit for 31st March 2021 in this section for getting the affordable housing project approved be extended to 31st March 2022 and same outer time limit be also provided for the proposed affordable rental housing project.

This amendment will take effect from 1st April, 2022 and will accordingly apply to the assessment year 2022-23 and subsequent assessment years.

[clause 26]Tax incentives for units located in International Financial Services Centre (IFSC)

Government has establishment a world class financial services centre. Units located in IFSC enjoy some concession. In order to make location in IFSC more attractive, it is proposed to provide the following additional incentives:

- It is proposed to amend section 9A of the Act to provide that the Central Government may, by notification in the Official Gazette, specify that any one or more of the conditions specified in clauses(a) to (m) of sub-section(3) or clauses (a) to (d) of sub-section (4) of section 9A of the Act shall not apply (or apply with modification) to an eligible investment fund or its eligible fund manager, if the fund manager is located in an International Financial Services Centre and has commenced operations on or before the 31st day of March, 2024.

- It is also proposed to amend clause (4D) of section 10 of the Act so as to provide that the exemption under this clause shall also be available in case of any income accrued or arisen to, or received to the investment division of offshore banking unit to the extent attributable to it and computed in the prescribed manner.

- It is also proposed to amend the expression ―specified fund‖ to include under the purview the investment division of offshore banking unit which has been granted a category III AIF registration and fulfils other conditions to be prescribed including the condition of maintaining separate books for its investment division. The investment division of offshore banking unit is proposed to be defined as an investment division of a banking unit of a nonresident located in an International Financial Services Centre and which has commenced operation on or before the 31st day of March, 2024.

- It is also proposed to insert new clause (4E) in of section 10 of the Act so as to exempt any income accrued or arisen to, or received by a non-resident as a result of transfer of non-deliverable forward contracts entered into with an offshore banking unit of International Financial Services Centre which commenced operations on or before the 31st day of Mach, 2024 and fulfils prescribed conditions.

- It is also proposed to insert new clause (4F) in of section 10 of the Act so as to exempt any income of a non-resident by way of royalty on account of lease of an aircraft in a previous year paid by a unit of an International Financial Services Centre, if the unit is eligible for deduction under section 80LA for that previous year and has commenced operation on or before the 31st day of the March, 2024.

- It is also proposed to insert new clause (23FF) in of section 10 of the Act so as to exempt any income of the nature of capital gains, arising or received by a non-resident, which is on account of transfer of share of a company resident in India by the resultant fund and such shares were transferred from the original fund to the resultant fund in relocation, if capital gains on such shares were not chargeable to tax had that relocation not taken place.

―Original Fund‖ is proposed to be defined as a fund established or incorporated or registered outside India, which collects funds from its members for investing it for their benefit and fulfils the following conditions, namely:—

- the fund is not a person resident in India;

- the fund is a resident of a country or a specified territory with which an agreement referred to in sub-section (1) of section 90 or sub-section (1) of section 90A has been entered into; or is established or incorporated or registered in a country or a specified territory notified by the Central

Government in this behalf;

- the fund and its activities are subject to applicable investor protection regulations in the country or specified territory where it is established or incorporated or is a resident; and

- fulfils such other conditions as prescribed;

―Relocation‖ is proposed to be defined as transfer of assets of the original fund to a resultant fund on or before the 31st day of March, 2023, where consideration for such transfer is discharged in the form of share or unit or interest in the resulting fund to the shareholder or unit holder or interest holder of the original fund in the same proportion in which the share or unit or interest was held by such shareholder or unit holder or interest holder in such original fund.

―Resultant fund‖ is proposed to be defined as a fund established or incorporated in India in the form of a trust or a company or a limited liability partnership, which-

- has been granted a certificate of registration as a Category I or Category II or Category III Alternative Investment Fund, and is regulated under the Securities and Exchange Board of India (Alternative Investment Fund) Regulations, 2012, made under the Securities and exchange Board of India Act, 1992 (15 of 1992); and

- is located in any International Financial Services Centre as referred to in sub-section (1A) of section 80LA.

- It is also proposed to amend section 47 of the Act to insert new clauses in the said section so as to provide that any transfer, in relocation, of a capital asset by the original fund to the resultant fund shall not be considered as transfer for capital gain tax purpose. It is also proposed to provide another clause to provide that any transfer by a shareholder or unit holder or interest holder, in a relocation, of a capital asset being a share or unit or interest held by him in the original fund in consideration for the share or unit or interest in the resultant fund shall not be treated as transfer for the purpose of capital gains. The definition of ―Original Fund‖, ―Relocation‖ and Resultant Fund shall be as already described above.

(vii) Consequential amendments shall be proposed in section 49, 56 and 79 of the Act on account of such relocation.

- It is also proposed to amend the section 80LA of the Act to:

- provide that deduction under said section is also available to a unit of International Financial Services Centre if it is registered under the International Financial Services Centre Authority Act, 2019 and thereby removing the earlier requirement of obtaining permission under any other relevant law.

- provide that the income arising from transfer of an asset, being an aircraft or aircraft engine which was leased by a unit referred to in clause (c) of sub-section (2) of said section to a domestic company engaged in the business of operation of aircraft before such transfer shall also be eligible for 100% deduction subject to condition that the unit has commenced operation on or before the 31st March 2024.

- to provide that in case the unit is registered under the International Financial Services Centre Authority Act, 2019 then the copy of permission shall mean a copy of the registration obtained under the International Financial Services Centre Authority Act, 2019.

- It is proposed to amend section 115AD to make the provision of this section applicable to investment division of an offshore banking unit in the same manner as it applies to specified fund. However, the provisions of this section shall apply to the extent of income that is attributable to the investment division of such banking unit as a Category-III portfolio investor under the Securities and exchange Board of India (Foreign Portfolio investors) Regulations, 2019 made under the Securities And Exchange Board of India Act, 1992 (15 of 1992), calculated in the prescribed manner.

The expression ―investment division of offshore banking unit‖ is also proposed to have the meaning as defined in Para (iii).

These amendments will take effect from 1st April, 2022 and will accordingly apply to the assessment year 2022-23 and subsequent assessment years.

[Clauses 4,5,15, 17, 21, 23 and 30]Issuance of zero coupon bond by infrastructure debt fund

Clause (48) of section 2 of the Act provides for definition of zero coupon bond, as a bond issued by any infrastructure capital company or infrastructure capital fund or public sector company or scheduled bank and in respect of which no payment and benefit is received or receivable before maturity or redemption. These are required to be notified by the Central Government in the Official Gazette.

In order to enable infrastructure debt fund [which are notified by the Central Government in the Official Gazette under clause (47) of section 10 of the Act] to issue zero coupon bond necessary amendments are proposed in clause (48) of section 2 of the Act. Rules 2F and 8B of Income-tax Rules shall be amendment subsequently after the Finance Bill 2021 is enacted.

This amendment will take effect from 1st April, 2022 and will accordingly apply to the assessment year 2022-23 and subsequent assessment years.

[Clause 3]Consequential amendment has also been proposed in clause (x) of sub-section (3) of section 194A of the Act which will take effect from 1st April, 2021

[Clause 45]Tax neutral conversion of Urban Cooperative Bank into Banking Company

Section 44DB of Act provides for computing deductions in the case of business re-organization of cooperative banks. Further, the said section, inter alia, provides that where such business reorganization of co-operative banks takes place, the deductions under sections 32, 35D, 35DD and section 35DDA will be apportioned between the predecessor co-operative bank and the successor cooperative bank in the proportion of the number of days before and after the date of business reorganization. Further transfer of a capital asset by the predecessor cooperative bank to the successor co-operative bank, as well as transfer of shares by the shareholders in the predecessor co-operative bank, in a case of business reorganization under section 47 of the Act, is also not regarded as transfer.

The Reserve Bank of India (RBI) has permitted voluntary transition of primary cooperative bank [urban co-operative banks (UCB)] into a banking company by way of transfer of Assets and Liabilities vide Circular reference no. DCBR.CO.LS.PCB. Cir.No.5/07.01.000/2018-19 dated September 27, 2018.

It is proposed to expand the scope of business reorganization to include conversion of a primary co-operative bank to a banking company and the deductions available under section 44DB of the Act shall also be made applicable in relation to such conversion of primary co-operative bank to the banking company. Further it is also proposed that transfer of a capital asset by the primary co-operative bank to the banking company as a result of conversion shall not be treated as transfer under section 47 of the Act. Consequently, the allotment of shares of the converted banking company to the shareholders of the predecessor primary co-operative bank shall not be treated as transfer under the said section of the Act.

Necessary amendments to this effect have been proposed in section 44DB and in clause (vica) and clause (vicb) of section 47 of the Act.

These amendments will take effect from 1st April, 2021 and will accordingly apply to the assessment year 2021-22 and subsequent assessment years.

[Clauses 13 and 15]Facilitating strategic disinvestment of public sector company

Section 2 of the Act provides the definitions for the purposes of the Act. Clause (19AA) of the said section defines that ―demerger”, in relation to companies, means the transfer, pursuant to a scheme of arrangement under sections 391 to 394 of the Companies Act, 1956 (1 of 1956), by a demerged company of its one or more undertakings to any resulting company on satisfaction of conditions prescribed in the said clause.

Section 72A of the Act provides provisions relating to carry forward and set off of accumulated loss and unabsorbed depreciation allowance in amalgamation or demerger, etc. Sub-section (1) of section 72A of the Act provides that the accumulated loss and unabsorbed depreciation of the amalgamating company or companies shall be deemed to be the accumulated losses and unabsorbed depreciation of the amalgamated company or companies in specified cases and subject to the conditions specified in the said section.

It is proposed to relax the provisions of these two sections for public sector companies in order to facilitate strategic disinvestment by the Government. Accordingly, it is proposed to carry out the following amendments-

- It is proposed to amend clause (19AA) of section 2 of the Act to insert Explanation 6 to clarify that the reconstruction or splitting up of a public sector company into separate companies shall be deemed to be a demerger, if

- such reconstruction or splitting up has been made to transfer any asset of the demerged company to the resultant company; and

- the resultant company is a public sector company on the appointed date indicated in the scheme approved by the Government or any other body authorised under the provisions of the Companies Act, 2013 or any other Act governing such public sector companies in this behalf; and fulfils such other conditions as may be notified by the Central Government in the Official Gazette.

- It is proposed to amend sub-section (1) of section 72A of the Act,

- to substitute clause (c) to provide that the provision of subsection (1) of section 72A shall also apply in case of amalgamation of one or more public sector company or companies with one or more public sector company or companies.

- to insert clause (d) to provide that the provision of sub-section (1) of section 72A shall also apply in case of amalgamation of an erstwhile public sector company with one or more company or companies, if

- the share purchase agreement entered into under strategic disinvestment restricted immediate amalgamation of the said public sector company; and

- the amalgamation is carried out within five year from the end of the previous year in which the restriction on amalgamation in the share purchase agreement ends.

- to insert a proviso to sub-section (1) to provide that the accumulated loss and the unabsorbed depreciation of the amalgamating company, in case of an amalgamation referred to in clause (d), which is deemed to be loss or, as the case may be, allowance for unabsorbed depreciation of the amalgamated company shall not be more than the accumulated loss and unabsorbed depreciation of the public sector company as on the date on which the public sector company ceases to be a public sector company as a result of strategic disinvestment;

- to insert an Explanation to sub-section (1) to define the followings:-

- ―Control‖ shall have the same meaning as assigned to in clause (27) of Section 2 of the Companies Act, 2013;

- ―Erstwhile public sector company‖ means a company which was a public sector company in earlier previous years and ceases to be a public sector company by way of strategic disinvestment by the Government.

- ―Strategic disinvestment‖ shall mean sale of shareholding by the Central Government or any State Government in a public sector company which results in reduction of its shareholding to below 51%, along with transfer of control to the buyer.

These amendments will take effect from 1st April, 2021 and will accordingly apply to the assessment year 2021-22 and subsequent assessment years.

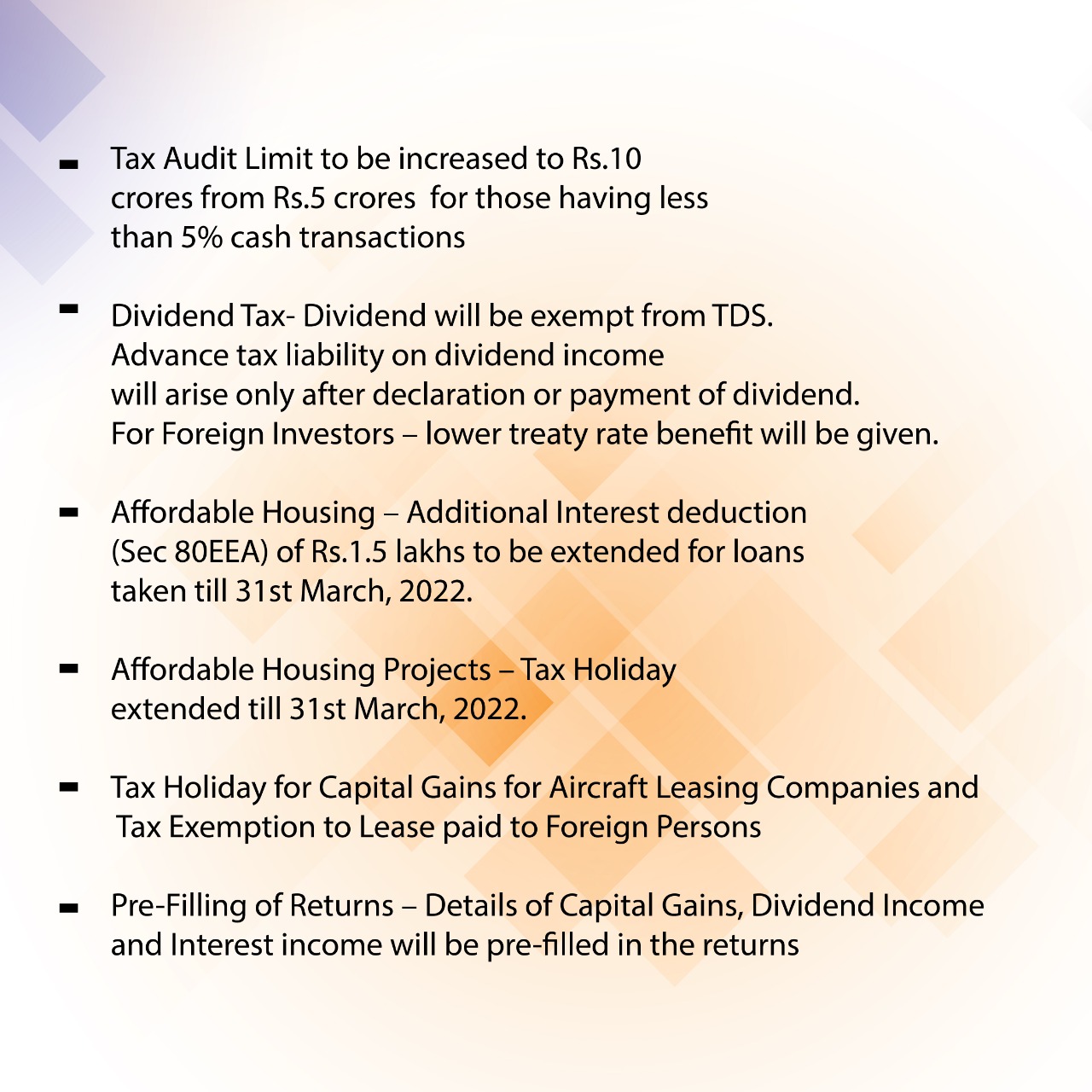

[Clauses 3 and 22]Extension of date of sanction of loan for affordable residential house property

The existing provision of the section 80EEA of the Act, inter alia, provides a deduction in respect of interest on loan taken for a residential house property from any financial institution up to one lakh fifty-thousand rupees subject to the condition that the loan has been sanctioned during the period beginning on 1st April, 2019 and ending on 31st March, 2021. There are further conditions that the stamp duty value of residential house property does not exceed forty-five lakh rupees and the assessee does not own any residential house property on the date of sanction of loan. This provision allows deduction to the first time home buyers, in respect of interest on home loan. In order to help such first time home buyers further, it is proposed to amend the provision of section 80EEA of the Act to extend the outer date for sanction of loan from 31st March 2021 to 31st March 2022.

This amendment will take effect from 1st April, 2022 and will accordingly apply to the assessment year 2022-23 and subsequent assessment years.

[Clause 24]Extension of date of incorporation for eligible start up for exemption and for investment in eligible start-up

The existing provisions of the section 80-IAC of the Act, inter alia, provides for a deduction of an amount equal to hundred percent of the profits and gains derived from an eligible business by an eligible start-up for three consecutive assessment years out of ten years at the option of the assessee. This is subject to the condition that the total turnover of its business does not exceed one hundred crore rupees. The eligible start-up is required to be incorporated on or after 1st day of April, 2016 but before 1st day of April 2021.

The existing provisions of the section 54GB of the Act, inter alia, provide for exemption of capital gain which arises from the transfer of a long-term capital asset, being a residential property (a house or a plot of land), owned by the eligible assessee. The assessee is required to utilise the net consideration for subscription in the equity shares of an eligible start-up, before the due date of furnishing of return of income under sub-section (1) of section 139 of the Act. The eligible start-up is required to utilise this amount for purchase of new asset within one year from the date of subscription in equity shares by the assessee. Further, it has been provided that benefit is available only when the residential property is transferred on or before 31st March, 2021.

In order to help such eligible start-up and help investment in them,-

- it is proposed to amend the provisions of section 80-IAC of the Act to extend the outer date of incorporation to before 1st April, 2022; and

- it is proposed to amend the provisions of section 54GB of the Act to extend the outer date of transfer of residential property from 31st March 2021 to 31st March 2022.

These amendments will take effect from 1st April, 2021.

[Clauses 19 and 25]Removing difficulties faced by taxpayers

Increase in safe harbour limit of 10% for home buyers and real estate developers selling such residential units

Section 43CA of the Act, inter alia, provides that where the consideration declared to be received or accruing as a result of the transfer of land or building or both, is less than the value adopted or assessed or assessable by any authority of a State Government (i.e. ―stamp valuation authority‖) for the purpose of payment of stamp duty in respect of such transfer, the value so adopted or assessed or assessable shall for the purpose of computing profits and gains from transfer of such assets, be deemed to be the full value of consideration. The said section also provide that where the value adopted or assessed or assessable by the authority for the purpose of payment of stamp duty does not exceed one hundred and ten per cent of the consideration received or accruing as a result of the transfer, the consideration so received or accruing as a result of the transfer shall, for the purposes of computing profits and gains from transfer of such asset, be deemed to be the full value of the consideration.

Clause (x) of sub-section (2) of section 56 of the Act, inter alia, provides that where any person receives, in any previous year, from any person or persons on or after 1st April, 2017, any immovable property, for a consideration which is less than the stamp duty value of the property by an amount exceeding fifty thousand rupees, the stamp duty value of such property as exceeds such consideration shall be charged to tax under the head ―income from other sources‖. It also provide that where the assessee receives any immovable property for a consideration and the stamp duty value of such property exceeds ten per cent of the consideration or fifty thousand rupees, whichever is higher, the stamp duty value of such property as exceeds such consideration shall be charged to tax under the head ―Income from other sources‖.

In order to boost the demand in the real-estate sector and to enable the real-estate developers to liquidate their unsold inventory at a lower rate to home buyers, it is proposed to increase the safe harbour threshold from existing 10% to 20% under section 43CA of the Act, if the following conditions are satisfied:-

- The transfer of residential unit takes place during the period from 12th November, 2020 to 30th June, 2021

- The transfer is by way of first time allotment of the residential unit to any person

- The consideration received or accruing as a result of such transfer does not exceed two crore rupee

Further it is proposed to provide the consequential relief to buyers of these residential units by way of amendment in clause (x) of sub-section (2) of section 56 of the Act by increasing the safe harbour from 10% to 20%. Accordingly, for these transactions, circle rate shall be deemed as sale/purchase consideration only if the variation between the agreement value and the circle rate is more than 20%.

These amendments will take effect from 1st April, 2021 and will accordingly apply to the assessment year 2021-22 and subsequent assessment years.

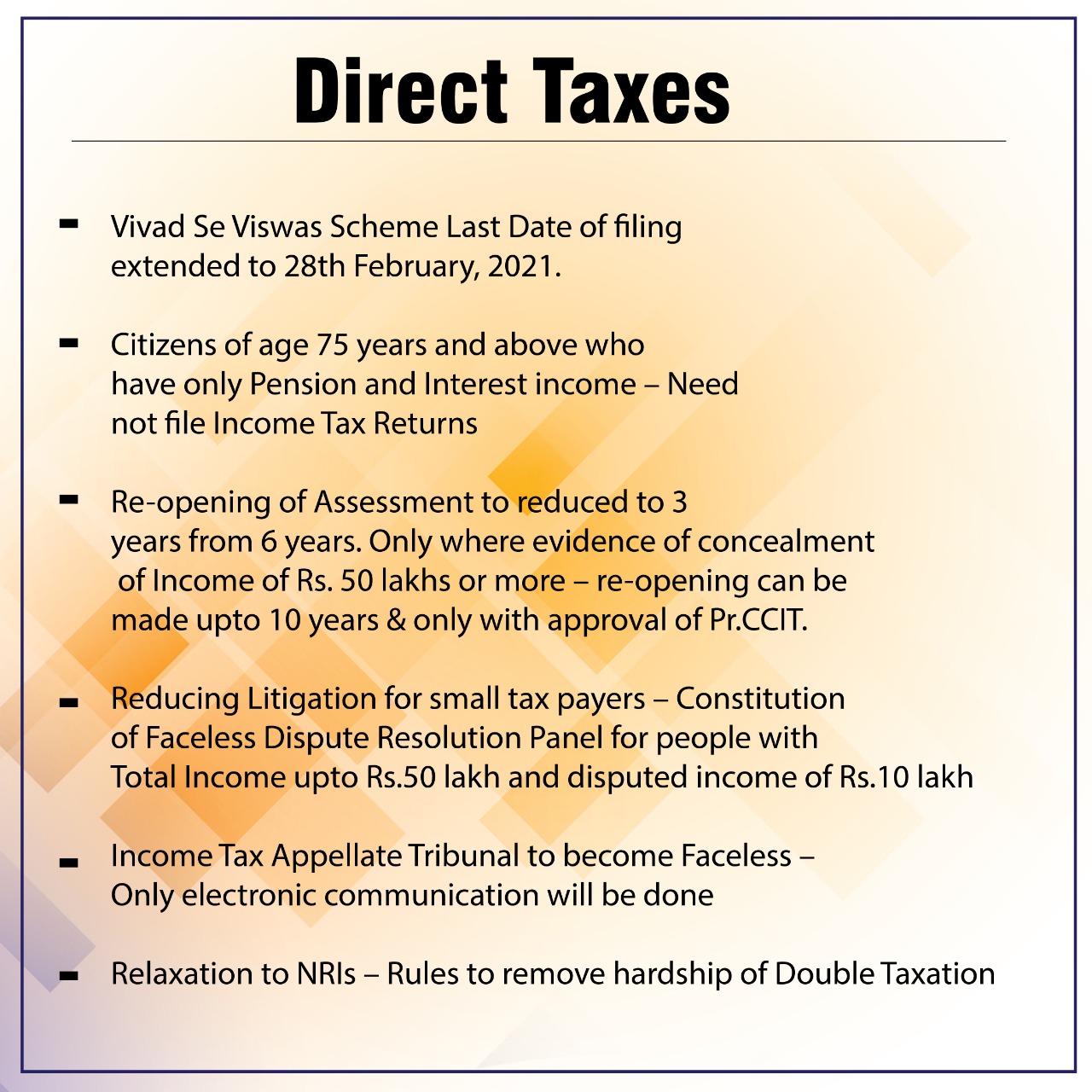

[Clauses 10 and 21] Relaxation for certain category of senior citizen from filing return of income-tax

Section 139 of the Act provides for filing of return of income. Sub-section (1) of the section provides that every person being an individual, if his total income or the total income of any other person in respect of which he is assessable under this Act during the previous year exceeded the maximum amount which is not chargeable to income-tax, shall, on or before the due date, furnish a return of his income.

In order to provide relief to senior citizens who are of the age of 75 year or above and to reduce compliance for them, it is proposed to insert a new section to provide a relaxation from filing the return of income, if the following conditions are satisfied:-

- The senior citizen is resident in India and of the age of 75 or more during the previous year;

- He has pension income and no other income. However, in addition to such pension income he may have also have interest income from the same bank in which he is receiving his pension income;

- This bank is a specified bank. The Government will be notifying a few banks, which are banking company, to be the specified bank; and

- He shall be required to furnish a declaration to the specified bank. The declaration shall be containing such particulars, in such form and verified in such manner, as may be prescribed.

Once the declaration is furnished, the specified bank would be required to compute the income of such senior citizen after giving effect to the deduction allowable under Chapter VI-A and rebate allowable under section 87A of the Act, for the relevant assessment year and deduct income tax on the basis of rates in force. Once this is done, there will not be any requirement of furnishing return of income by such senior citizen for this assessment year.

This amendment will take effect from 1st April, 2021.

[Clause 47]Rationalisation of provisions related to Sovereign Wealth Fund (SWF) and Pension Fund (PF)

Clause (23FE) of section 10 of the Act provides for the exemption to specified persons from the income in the nature of dividend, interest or long-term capital gains arising from an investment made by it in India. Specified persons are SWF or PF which fulfils conditions prescribed therein and are specified for this purpose by the Central Government through notification in the Official Gazette. This provision was introduced through the Finance Act, 2020 to encourage investments of SWF and PF into infrastructure sector of India. Subsequent to enactment, a notification was also issued to enlarge the scope of infrastructure activities eligible for investments. One SWF has already been notified under this provision. In order to rationalise the provision of this clause and to remove the difficulties in meeting some of the conditions, the followings amendments are proposed in the Bill:

- Allowing Alternate Investment Fund (AIF) to invest up to 50% in non-eligible investments

Presently SWF/PFs may invest in a Category-I or Category-II Alternative Investment Fund, having 100% investment in eligible infrastructure company. It is proposed to:

- relax the condition of 100% to 50%.

- allow the investment by Category-I or Category-II AIF in an Infrastructure Investment Trust (InvIT).

- Exemption under this clause shall be calculated proportionately, in case if aggregate investment of AIF in infrastructure company or companies or in InvIT is less than 100%.

- Investment through holding company

Presently, SWF/PFs are not allowed to invest through holding company. It is proposed to allow the same subject to the following conditions:

- Holding company should be a domestic company.

- It should be set up and registered on or after 1st April, 2021.

- It should have minimum 75% investments in one or more infrastructure companies.

- Exemption under this clause shall be calculated proportionately, in case if aggregate investment of holding company in infrastructure company or companies is less than 100%

Investment in NBFC- IDF/IFC (non-banking finance company-infrastructure debt fund/Infrastructure finance company)

Presently, SWF/PFs are not allowed to invest in NBFC-IFC/IDF. It is proposed to allow the same subject to the following conditions:

- NBFC-IDF/IFC should have minimum 90% lending to one or more infrastructure entities.

- Exemption under this clause shall be calculated proportionately, in case if aggregate lending of NBFC-IDF or NBFC-IFC in infrastructure company or companies is less than 100%.

- Loan or borrowings by SWF/Pension Fund

Presently, SWF/PFs are not allowed to have loans or borrowings or deposit or investments as there is a condition that no benefit should enure to private person. It is proposed to provide that there should not be any loan or borrowing for the purpose of making investment in India. It is also proposed to provide that the condition regarding no benefit to private person and assets going to government on dissolution would not apply to any payment made to creditor or depositor for loan taken or borrowing other than for the purpose of making investment in India.

- Commercial activity

Presently, SWF/PFs are not allowed to undertake any commercial activity. This condition is proposed to be removed and replaced with a condition that SWF/PFs shall not participate in day to day operation of investee. However, appointing director and executive director for monitoring the investment would not amount to participation in day to day operation.The term “investee” is propoed to define to mean a business trust or a company or an enterprise or an entity or a category I or II Alternative Investment Fund or an Infrastructure Investment Trust or a domestic company or an Infrastructure Finance Company or an Infrastrure Debt Fund, in which the SWF or PF, as the case may be, has made the investment, directly or indirectly, under the provisions of this clause.

- Liable to Tax

Presently, some PFs are liable to tax in their country though given exemption subsequently. It is proposed to amend this sub-clause to provide that if pension fund is liable to tax but exemption from taxation for all its income has been provided by the foreign country under whose laws it is created or established, then such pension fund shall also be eligible.

- Rules to prescribe the method of calculation

It is also proposed to provide that the Central Government may prescribe the method of calculation of 50% or 75% or 90%referred above.

This amendment will take effect from 1st April, 2021 and will accordingly apply to the assessment year 2021-22 and subsequent assessment years.

[Clause 5]Addressing mismatch in taxation of income from notified overseas retirement fund

Representations have been received that there is mismatch in the year of taxability of withdrawal from retirement funds by residents who had opened such fund when they were non-resident in India and resident in foreign countries. At present the withdrawal from such funds may be taxed on receipt basis in such foreign countries, while on accrual basis in India. In order to address this mismatch and remove this genuine hardship, it is proposed to insert a new section 89A to the Act to provide that the income of a specified person from specified account shall be taxed in the manner and in the year as prescribed by the Central Government. It is also proposed to define the expression ―specified person‖, as a person resident in India who opened a specified account in a notified country while being non-resident in India and resident in that country. ―Specified account‖ is proposed to be defined as an account maintained in a notified country which is maintained for retirement benefits and the income from such account is not taxable on accrual basis and is taxed by such country at the time of withdrawal or redemption. ―Notified country‖ is proposed to be defined to mean a country notified by the Central Government for the purposes of this section in the Official Gazette.

This amendment will take effect from 1st April, 2022 and will accordingly apply to the assessment year 2022-23 and subsequent assessment years.

[Clause 28]Rationalisation of provisions of Minimum Alternate Tax (MAT)

Section 115JB of the Act provides for MAT at the rate of fifteen per cent of its book profit, in case tax on the total income of a company computed under the provisions of the Act is less than the fifteen per cent of book profit. Book profit for this purpose is computed by making certain adjustments to the profit disclosed in the profit and loss account prepared by the company in accordance with the provisions of the Companies Act, 2013.

Representations were received that the computation of book profit under section 115JB does not provide for any adjustment on account of additional income of past year(s) included in books of account of current year on account of secondary adjustment under section 92CE or on account of an Advance Pricing Agreement (APA) entered with the taxpayer under section 92CC. Representation has also been received that since dividend income is now taxable in the hand of shareholders, dividend received by a foreign company on its investment in India is required to be excluded for the purposes of calculation of book profit in case the tax payable on such dividend income is less than MAT liability on account of concessional tax rate provided in the Double Taxation Avoidance Agreement (DTAA). Hence it is proposed to,-

- provide that in cases where past year income is included in books of account during the previous year on account of an APA or a secondary adjustment, the Assessing Officer shall, on an application made to him in this behalf by the assessee, recompute the book profit of the past year(s) and tax payable, if any, during the previous year, in the prescribed manner. Further, the provision of section 154 of the Act shall apply so far as possible and the period of four years specified in sub-section (7) of section 154 shall be reckoned from the end of the financial year in which the said application is received by the Assessing Officer.

- to provide similar treatment to dividend as already there for capital gains on transfer of securities, interest, royalty and Fee for Technical Services (FTS) in calculating book profit for the purposes of section 115JB of the Act, so that both specified dividend income and the expense claimed in respect thereof are reduced and added back, while computing book profit in case of foreign companies where such income is taxed at lower than MAT rate due to DTAA.

This amendment will take effect from 1st April, 2021 and will accordingly apply to the assessment year 2021-22 and subsequent assessment years.

[Clause 31]Exemption of deduction of tax at source on payment of Dividend to business trust in whose hand dividend is exempt

Section 194 of the Act provides for deduction of tax at source (TDS) on payment of dividends to a resident. The second proviso to this section provides that the provisions of this section shall not apply to such income credited or paid to certain insurance companies or insurers. It is proposed to amend second proviso to section 194 of the Act to further provide that the provisions of this section shall also not apply to such income credited or paid to a business trust by a special purpose vehicle or payment of dividend to any other person as may be notified.

This amendment will take effect retrospectively from 1st April, 2020.

[Clause 44]Rationalisation of the provision concerning withholding on payment made to Foreign Institutional Investors (FIIs)

Section 196D of the Act provides for deduction of tax on income of FII from securities as referred to in clause (a) of sub-section (1) of section 115AD of the Act (other than interest referred in section 194LD of the Act) at the rate of 20 per cent.

Since the said section provides for TDS at a specific rate indicated therein, the deduction is to be made at that rate and the benefit of agreement under section 90 or section 90A of the Act cannot be given at the time of tax deduction. The situation is different in cases where the provision mandates TDS at rate in force. This is for the reason that the definition of the expression ―rate in force‖, in clause (37A) of section 2 of the Act, allows benefit of agreement under section 90 or section 90A in determining the rate of tax at which the tax is to be deducted at source. This principle of tax deduction has also been upheld by Hon‘ble Supreme Court in the case of PILCOM vs. CIT West Bengal (Civil Appeal No. 5749 of 2012).

Representations have been received requesting that the benefit of agreements under section 90 or section 90A of the Act may be considered at the time of tax deduction on payments to FIIs. Accordingly, it is proposed to insert a proviso to subsection (1) of section 196D of the Act to provide that in case of a payee to whom an agreement referred to in sub-section (1) of section 90 or sub-section (1) of section 90A applies and such payee has furnished the tax residency certificate referred to in sub-section (4) of section 90 or sub-section (4) of section 90A of the Act, then the tax shall be deducted at the rate of twenty per cent. or rate or rates of income-tax provided in such agreement for such income, whichever is lower.

This amendment will take effect from 1st April, 2021.

[Clause 49]Rationalisation of provisions relating to tax audit in certain cases

Under section 44AB of the Act, every person carrying on business is required to get his accounts audited, if his total sales, turnover or gross receipts, in business exceed or exceeds one crore rupees in any previous year. In case of a person carrying on profession he is required to get his accounts audited, if his gross receipt in profession exceeds, fifty lakh rupees in any previous year. In order to reduce compliance burden on small and medium enterprises, through Finance Act 2020, the threshold limit for a person carrying on business was increased from one crore rupees to five crore rupees in cases where,-

- aggregate of all receipts in cash during the previous year does not exceed five per cent of such receipt; and

- aggregate of all payments in cash during the previous year does not exceed five per cent of such payment.

In order to incentivise non-cash transactions to promote digital economy and to further reduce compliance burden of small and medium enterprises, it is proposed to increase the threshold from five crore rupees to ten crore rupees in cases listed above.

This amendment will take effect from 1st April, 2021 and will accordingly apply for the assessment year 2021-22 and subsequent assessment years.

[Clause 11]Advance tax instalment for dividend income

Section 234C of the Act provides for payment of interest by an assessee who does not pay or fails to pay on time the advance tax instalments as per section 208 of the Act. The assessee is liable to pay a simple interest at the rate of 1% per month for a period of three months on the amount of shortfall calculated with respect to the due dates for advance tax instalments.

The first proviso of the sub section (1) provides for the relaxation that if the shortfall in the advance tax instalment or the failure to pay the same on time is on account of the income listed therein, no interest under section 234C shall be charged provided the assessee has paid full tax in subsequent advance tax instalments. These exclusions are: –

- the amount of capital gains; or

- income of the nature referred to in sub-clause (ix) of clause (24) of section 2; or

- income under the head “Profits and gains of business or profession” in cases where the income accrues or arises under the said head for the first time; or

- income of the nature referred to in sub-section (1) of section 115BBDA.

Aforesaid relaxation is to insulate the taxpayers from payment of interest under section 234C of the Act in cases where accurate determination of advance tax liability is not possible due to the intrinsic nature of the income. Therefore, after considering various representations favourably, it is proposed to include dividend income in the above exclusion but not deemed dividend as per sub-clause (e) of clause (22) of section 2 of the Act.

This amendment will take effect from 1st April, 2021 and will accordingly apply to the assessment year 2021-22 and subsequent assessment years.

[Clause 53]Raising of prescribed limit for exemption under sub-clause (iiiad) and (iiiae) of clause

(23C) of section 10 of the Act

Clause (23C) of section 10 of the Act provides for exemption of income received by any person on behalf of different funds or institutions etc. specified in different subclauses.

Sub-clauses (iiiad) of clause (23C) of the section 10 provides for the exemption for the income received by any person on behalf of university or educational institution as referred to in that sub-clause. The exemptions under the said sub-clause are available subject to the condition that the annual receipts of such university or educational institution do not exceed the annual receipts as may be prescribed. Similarly, sub-clauses (iiiae) of clause (23C) of the section provides for the exemption for the income received by any person on behalf of hospital or institution as referred to in that sub-clause. The exemptions under the said sub-clause are available subject to the condition that the annual receipts of such hospital or institution do not exceed the annual receipts as may be prescribed. The presently prescribed limit for these two sub-clauses is Rs 1 crore as per Rule 2BC of the Income-tax Rule.

Representations have been received to increase this limit of Rs 1 crore, as provided under Rule 2BC. In order to provide benefit to small trust and institutions, it has been proposed that the exemption under sub-clause (iiiad) and (iiiae) shall be increased to Rs 5 crore and such limit shall be applicable for an assessee with respect to the aggregate receipts from university or universities or educational institution or institutions as referred to in sub-clause (iiiad) as well as from hospital or hospitals or institution or institutions as referred to in sub-clause (iiiae).

This amendment will take effect from 1st April, 2022 and will accordingly apply to the assessment year 2022-23 and subsequent assessment years.

[Clause 5]Extending due date for filing return of income in some cases, reducing time to file belated return and to revise original return and also to remove difficulty in cases of defective returns

Section 139 of the Act contains provisions in respect of the filing of return of income for different persons or class of persons. The said section also provides the due dates for filing of original, belated and revised returns of income for different classes of assessee.

Sub-section (1) of the section provides for the filing of original return of income for an assessment year. The Explanation 2 of the said section specifies the due-dates for filing of original return for different class of persons. The sub-clause (iii) of clause (a) of the said Explanation 2 provides that the due date for filing of original return of income for the partner of a firm whose accounts are required to be audited under the said Act or under any other law for the time being in force shall be 31st day of October of the assessment year.

Section 5A of the Act provides for taxation of spouses governed by Portuguese Civil Code. On account of this provision any income earned by a partner of a firm whose accounts are required to be audited shall be apportioned between the spouses and included in their total income, if the section 5A applies to them.

Since the total income of a partner can be determined after the books of accounts of such firm have been finalised, the due dates of partners are already aligned with the due date of the firm. Thus, the due date for filing of original return of income of such partner is 31st October of the assessment year. However, this relaxation is not there for spouse of such partner to whom section 5A of the Act applies. Therefore, it is proposed that the due date for the filing of original return of income be extended to 31st October of the assessment year in case of spouse of a partner of a firm whose accounts are required to be audited under this Act or under any other law for the time being in force, if the provisions of section 5A applies to them.

Further, in the case of a firm which is required to furnish report from an accountant for entering into international transaction or specified domestic transaction, as per section 92E of the Act, the due date for filing of original return of income is the 30th November of the assessment year. Since the total income of such partner can be determined after the books of accounts of such firm have been finalised, it is proposed that the due date of such partner be extended to 30th November of the assessment year.

Sub-sections (4) and (5) of section 139 of the Act contain provisions relating to the filing of belated and revised returns of income respectively. The belated or revised returns under sub-sections (4) and (5) respectively of the said section at present could be filed before the end of the assessment year or before the completion of the assessment whichever is earlier. With the massive technological upgrade in the Department where the processes under the Act are moving towards becoming faceless and jurisdiction-less, the time taken to conduct and complete such processes has greatly reduced. Therefore, it is proposed that the last date for filing of belated or revised returns of income, as the case may be, be reduced by three months. Thus the belated return or revised return could now be filed three months before the end of the relevant assessment year or before the completion of the assessment, whichever is earlier.

Sub-section (9) of section 139 of the Act lays down the procedure for curing a defective return. It provides that in case a return of income is found to be defective, the Assessing Officer will intimate the defect to the assessee and give him a period of 15 days or more to rectify the said defect and if the defect is not rectified within the said period, the return shall be treated as an invalid return and the assessee will be considered to have never filed a return of income. The Explanation to the subsection lists the conditions in which a certain return of income shall be considered to be defective. Representations have been received that the aforesaid conditions create difficulties for both the taxpayer and the Department, as a large number of returns become defective by application of the said conditions. This has resulted in a number of grievances. It has been represented that the conditions given in the said Explanation may be relaxed in genuine cases. Therefore, it is proposed that a proviso be inserted to the said Explanation empowering the Board to specify, vide notification thatany of the above conditions shall not apply for a class of assessee or shall apply with such modifications, as maybe specified in such notification.

These amendments will take effect from 1st April, 2021 and will accordingly apply to the assessment year 2021-22 and subsequent assessment years.

[Clause 32]Rationalisation of various Provisions

Payment by employer of employee contribution to a fund on or before due date

Clause (24) of section 2 of the Act provides an inclusive definition of the income. Sub-clause (x) to the said clause provide that income to include any sum received by the assessee from his employees as contribution to any provident fund or superannuation fund or any fund set up under the provisions of ESI Act or any other fund for the welfare of such employees.

Section 36 of the Act pertains to the other deductions. Sub-section (1) of the said section provides for various deductions allowed while computing the income under the head ‗Profits and gains of business or profession‘.

Clause (va) of the said sub-section provides for deduction of any sum received by the assessee from any of his employees to which the provisions of sub-clause (x) of clause (24) of section 2 apply, if such sum is credited by the assessee to the employee’s account in the relevant fund or funds on or before the due date. Explanation to the said clause provides that, for the purposes of this clause, “due date‖ to mean the date by which the assessee is required as an employer to credit an employee’s contribution to the employee’s account in the relevant fund under any Act, rule, order or notification issued there-under or under any standing order, award, contract of service or otherwise.

Section 43B specifies the list of deductions that are admissible under the Act only upon their actual payment. Employer’s contribution is covered in clause (b) of section 43B. According to it, if any sum towards employer’s contribution to any provident fund or superannuation fund or gratuity fund or any other fund for the welfare of the employees is actually paid by the assessee on or before the due date for furnishing the return of the income under sub-section (1) of section 139, assessee would be entitled to deduction under section 43B and such deduction would be admissible for the accounting year. This provision does not cover employee contribution referred to in clause (va) of sub-section (1) of section 36 of the Act.

Though section 43B of the Act covers only employer‘s contribution and does not cover employee contribution, some courts have applied the provision of section 43B on employee contribution as well. There is a distinction between employer contribution and employee‘s contribution towards welfare fund. It may be noted that employee‘s contribution towards welfare funds is a mechanism to ensure the compliance by the employers of the labour welfare laws. Hence, it needs to be stressed that the employer‘s contribution towards welfare funds such as ESI and PF needs to be clearly distinguished from the employee‘s contribution towards welfare funds. Employee‘s contribution is employee own money and the employer deposits this contribution on behalf of the employee in fiduciary capacity. By late deposit of employee contribution, the employers get unjustly enriched by keeping the money belonging to the employees. Clause (va) of sub-section (1) of Section 36 of the Act was inserted to the Act vide Finance Act 1987 as a measures of penalizing employers who mis-utilize employee‘s contributions.

Accordingly, in order to provide certainty, it is proposed to –

- amend clause (va) of sub-section (1) of section 36 of the Act by inserting another explanation to the said clause to clarify that the provision of section 43B does not apply and deemed to never have been applied for the purposes of determining the ―due date‖ under this clause; and

- amend section 43B of the Act by inserting Explanation 5 to the said section to clarify that the provisions of the said section do not apply and deemed to never have been applied to a sum received by the assessee from any of his employees to which provisions of sub-clause (x) of clause (24) of section 2 applies.

These amendments will take effect from 1st April, 2021 and will accordingly apply to the assessment year 2021-22 and subsequent assessment years.

[Clauses 8 and 9]Constitution of Dispute Resolution Committee for small and medium taxpayers

The Central Government has consciously adopted a policy to make the processes under the Act, which require interface with the taxpayer, fully faceless. In this backdrop, new schemes for faceless assessment, for faceless appeal at the level of Commissioner (Appeals) and for faceless imposition of penalty have already been made operational. Further, the Taxation and Other Laws (Relaxation and

Amendment of Certain Provisions) Act, 2020 has empowered the Central Government to introduce similar schemes for other functions being performed by the income-tax authorities.