Applicability of Tax Accounting Standards (ICDS) to Taxpayers Covered by Presumptive Tax Schemes

Taxpayers falling under the presumptive tax schemes are not subject to tax audit under section 44AB, since the limits for applicability of the schemes are the same as the threshold limits for tax audit. Therefore, an individual or HUF who/which falls under and opts to be covered by presumptive tax schemes would not be liable to such audit under section 44AB, and would fall under the exclusion under the notification. Hence ICDS would not apply. However, if a tax payer opts out of a presumptive taxation, he is required to get his/its accounts audited under section 44AB. In such a case the ICDS would apply.

A question arises as to what is the position of other categories of taxpayers whose income is taxed under presumptive tax schemes. The issue arises as there is no specific exclusion from ICDS for such presumptive tax cases.

Under the presumptive tax scheme, books of account are not relevant, since the income is computed on presumptive basis. It therefore, does not involve computation of income on the basis of the method of accounting, or on the basis of adjustments to the accounts. Further, provisions for determination of presumptive income, such as sections 44AD, 44ADA, 44AE, 44BB, 44BBA, 44BBB exclude the operation of sections 28 to 43C.

Section 145 applies for computation of income under these sections. Therefore, though there is no specific exclusion under the notification for taxpayers falling under the presumptive tax schemes from the purview of ICDS, logically, ICDS would not apply to such taxpayers.

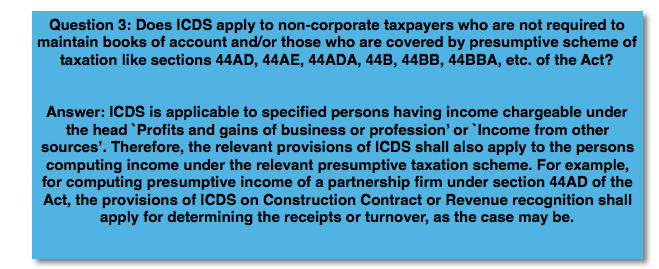

However, where the presumptive tax scheme involves computation of tax on the basis of gross receipts, turnover, etc., the CBDT has taken a view that the ICDS on revenue recognition would apply to compute the gross receipts or turnover in such cases. In this respect, a reference may be made to the clarifications on ICDS contained in the Circular no. 10/2017, dated 23rd March, 2017 issued by the CBDT. Question no. 3 and answer thereto are reproduced below:

By CA Ankit Gulgulia (Jain)

26th June, 2018

Taxpayers falling under the presumptive tax schemes are not subject to tax audit under section 44AB, since the limits for applicability of the schemes are the same as the threshold limits for tax audit. Therefore, an individual or HUF who/which falls under and opts to be covered by presumptive tax schemes would not be liable to such audit under section 44AB, and would fall under the exclusion under the notification. Hence ICDS would not apply. However, if a tax payer opts out of a presumptive taxation, he is required to get his/its accounts audited under section 44AB. In such a case the ICDS would apply.

A question arises as to what is the position of other categories of taxpayers whose income is taxed under presumptive tax schemes. The issue arises as there is no specific exclusion from ICDS for such presumptive tax cases.

Under the presumptive tax scheme, books of account are not relevant, since the income is computed on presumptive basis. It therefore, does not involve computation of income on the basis of the method of accounting, or on the basis of adjustments to the accounts. Further, provisions for determination of presumptive income, such as sections 44AD, 44ADA, 44AE, 44BB, 44BBA, 44BBB exclude the operation of sections 28 to 43C.

Section 145 applies for computation of income under these sections. Therefore, though there is no specific exclusion under the notification for taxpayers falling under the presumptive tax schemes from the purview of ICDS, logically, ICDS would not apply to such taxpayers.

However, where the presumptive tax scheme involves computation of tax on the basis of gross receipts, turnover, etc., the CBDT has taken a view that the ICDS on revenue recognition would apply to compute the gross receipts or turnover in such cases. In this respect, a reference may be made to the clarifications on ICDS contained in the Circular no. 10/2017, dated 23rd March, 2017 issued by the CBDT. Question no. 3 and answer thereto are reproduced below: