Introduction

The Indian Income Tax Act, while not imposing a strict cash deposit limit in Bank, has established reporting thresholds for banks to monitor large cash transactions. This measure is primarily aimed at curbing tax evasion, black money, and other financial irregularities. This blog post will delve deep into the intricacies of cash deposit limits, the implications of exceeding these thresholds, and the broader context of cash transactions in India.

Understanding the Cash Deposit Reporting Threshold

- Savings Accounts:

- Banks are mandated to report cash deposits exceeding ₹10 lakh in a financial year for savings accounts.

- While not a limit, this threshold triggers scrutiny from the Income Tax Department.

- The intent is to identify discrepancies between declared income and cash deposits.

- Current Accounts:

- The reporting threshold is higher for current accounts, standing at ₹50 lakh.

- This is due to the nature of current accounts, which are often used for business transactions.

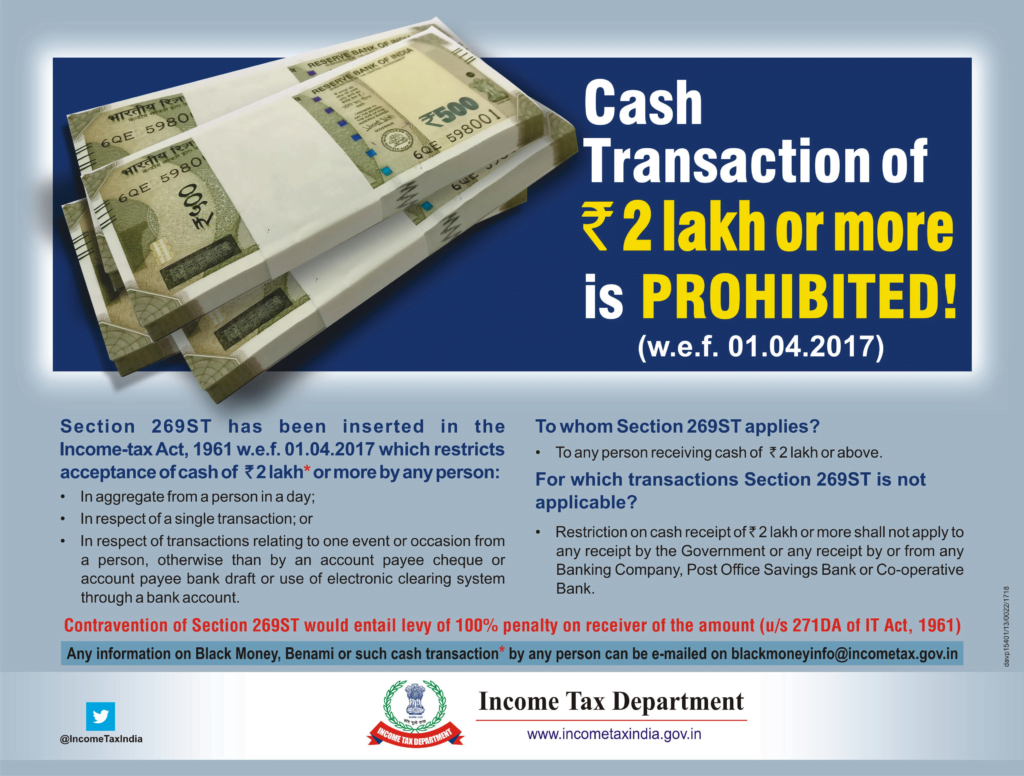

Cash Transaction Limit in India – Section 269ST

The Finance Act 2017, took various measures to restrain black money and as an outcome of these measures, a new Section 269ST was inserted in the Income Tax Act. As the Section 269ST imposed restrictions on a transaction, the cash transaction limit per day is limited to Rs.2 Lakhs per day. Section 269ST states that no person shall receive an amount of Rs 2 Lakh or more (cash receipt limit):

- In aggregate from a person in a day; or

- In respect of a single transaction; or

- In respect of transactions relating to one event or occasion from a person.

However, the Central Board of Direct Taxes (CBDT) has clarified that this cash withdrawal limit does not apply for withdrawals from Banks and Post offices.

Thus the provisions of section 269ST will not apply to:

- Cash received through an Account Payee Cheque or an Account Payee Bank draft or use of electronic clearing system (ECS) through a bank account.

- Any receipt by the Government, any banking company, post office savings bank or co-operative bank.

- Transactions of nature referred to in section 269SS.

- Such other persons or class of persons or receipts, which the Central Government may, by notification Official Gazette, specify.

Withdrawal from Post Office

- Post offices under the Department of India Post facilitate drawings from Post Office savings account along with ATM facility.

- The limit of cash that can be withdrawn in a single day from a post office or ATM is Rs.25,000 and is limited to Rs.10,000 per transaction.

- The post office permits five free transactions per month including financial and non-financial transactions (balance enquiry, statement request). Beyond the free transactions, Rs.20 with GST is charged.

- Withdrawal from other bank ATMs is admissible wherein it is upto 3 free transactions in metro cities while it is five free transactions in non-metro cities. A fee of Rs.20 with GST is charged for transactions above the free transactions.

Withdrawal from Banks

The amount deposited can be withdrawn from both savings account and current account using a chequebook/withdrawal slip or using automated teller machine through a debit card. Cash withdrawal limit varies from bank to bank and also depends on the type of card being used. It varies from 10,000 to 50,000 per day based on the bank. However, the transaction details notified by the State Bank of India is furnished below.

- Withdrawals using chequebook has been restricted to 60 withdrawals per half-year by most of the banks.

- The amount of money that can be debited from the current account is limited to Rs.1,00,000 per week whereas an overall of Rs.24,000 can be drawn per week from the savings account.

- ATM withdrawals allow Rs.10,000 to be drawn per day and permits unlimited free transactions for salary account whereas 3 transactions from other ATMs with a fee of Rs.20 plus GST per month.

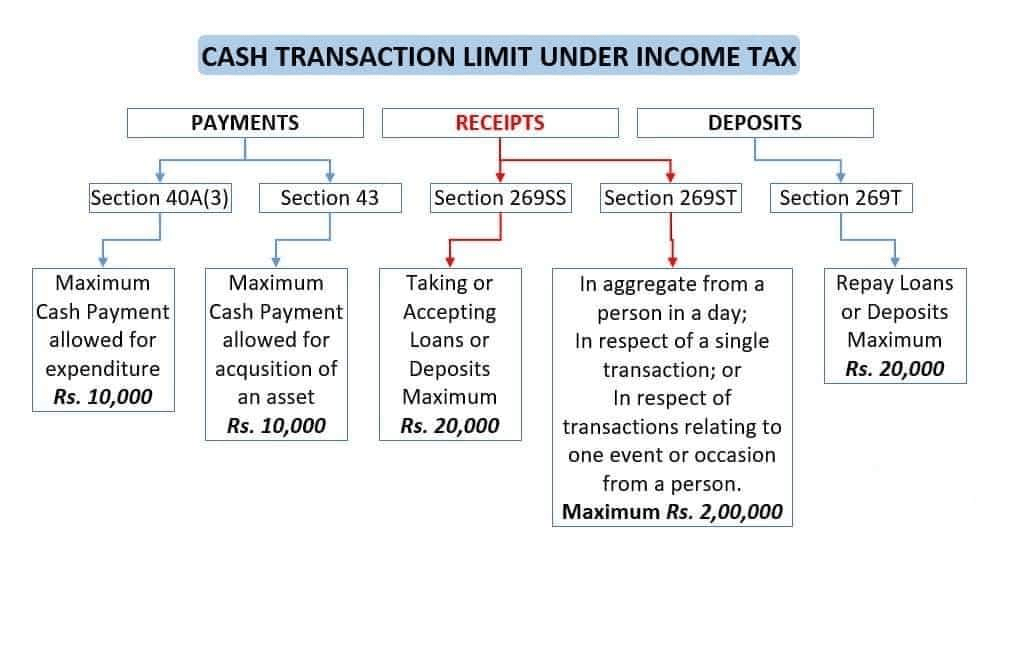

Cash Transaction Limit under Income Tax

The following are the main income tax sections that pertain to cash transaction limit in India:

- Section 40A(3) and Section 43 – Pertains to Cash Payment

- Section 269SS and Section 269ST – Pertains to Cash Receipts

- Section 269T – Pertains to Repayment of Certain Loans / Deposits

Section 40A(3) of Income Tax

Section 40A(3) of the Income Tax Act pertains to cash payment limit for expenditure made in cash. Under Section 40A(3), if payment for any expenditure of over Rs.10,000 is made in cash, then the expenditure will be disallowed under the Income Tax Act. Hence, it is important for all taxpayers to make any payment for the expense over Rs.10,000 through banking channels like debit card, account transfer, cheque or demand draft.

Section 43 of Income Tax

Under section 43 of Income Tax Act, if payment of more than Rs.10,000 is made by a taxpayer for the acquisition of an asset by cash, the expenditure would be ignored for the purposes of determination of actual cost of the asset. Hence, it is important for all taxpayers acquiring assets to make all payments to the seller through banking channels.

Section 269SS of Income Tax

Section 269SS prohibits a taxpayer from taking/accepting loans or deposits or a sum of more than Rs.20,000 in cash. All loans and deposits of more than Rs.20,000 must always be taken through a banking channel. Section 269SS of the Income Tax Act is however not applicable when accepting/taking loan or deposit from a person or entity mentioned below:

- Government;

- Any banking company, post office saving bank or co-operative bank;

- Any corporation established by a Central, State or Provincial Act

- Any Government company as defined in clause (45) of section 2 of the Companies Act, 2013

- An institution, association or body or class of institutions, associations or bodies notified by Central Government in the official gazette.

Finally, if the person from whom the loan or deposit is taken and the person by whom the loan or deposit is accepted, are both having agricultural income and neither have any income taxable under Income Tax Act, then the provisions of Section 269SS will not apply.

Penalty under Section 269SS

Failure to comply with provisions of section 269SS could lead to a penalty equal to the amount of loan or deposit or specified sum accepted.

Section 269ST of Income Tax Act – Cash receipt limit

Section 269ST of the Income Tax Act provides that no person can receive an amount of INR 2 Lakhs or more in cash:

- In aggregate from a person in a day;

- In respect of a single transaction; or

- In respect of transactions relating to one event or occasion from a person.

Provisions of Section 269ST are not applicable when cash of more than Rs.2 lakhs is received from the following persons:

- Government;

- Any banking company, post office saving bank or co-operative bank;

- An institution, association or body or class of institutions, associations or bodies notified by Central Government in its official gazette.

Penalty under Section 269ST

As per section 271DA, in case of failure to comply with provisions of section 269ST, a penalty amount equal to the amount of receipt is payable.

Section 269T of Income Tax Act

Section 269T provides that any branch of a banking company or a co-operative society, firm or another person cannot repay any loan or deposit otherwise than by an account payee cheque or account payee bank draft drawn in the name of the person, who has made the loan or deposit, if:

- The amount of the loan or deposit together with interest is INR 20,000 or more; or

- The aggregate amount of loans or deposits held by such person, either in his name or jointly with another person on the date of such repayment together with interest is INR 20,000 or more.

Provisions of section 269T are not applicable when the loan is repaid or deposit taken or accepted from below mentioned person:

- Government;

- Any banking company, post office saving bank or co-operative bank;

- Any corporation established by a Central, State or Provincial Act

- Any Government company as defined in clause (45) of section 2 of the Companies Act, 2013

- An institution, association or body or class of institutions, associations or bodies notified by Central Government in the official gazette.

Penalty under Section 269T

As per section 271E, in case of failure to comply with provisions of section 269T, penalty amount equal to the amount of loan or deposit repaid is payable.

Implications of Exceeding the Reporting Threshold

- Income Tax Scrutiny:

- Deposits exceeding the threshold will attract the attention of the Income Tax Department.

- Taxpayers may be required to justify the source of funds.

- Failure to provide satisfactory explanations could lead to tax assessments or penalties.

- Potential for Tax Evasion Detection:

- The reporting requirement helps identify individuals or businesses that might be underreporting their income.

- It aids in detecting unaccounted wealth and black money.

- Anti-Money Laundering Measures:

- Large cash deposits can be linked to money laundering activities.

- Banks and tax authorities collaborate to prevent such illegal transactions.

Cash Deposits and Income Tax Returns

- Correlation Between Deposits and Income:

- The Income Tax Department often cross-verifies cash deposits with declared income.

- Significant discrepancies can raise red flags.

- Importance of Accurate Income Declaration:

- Honest and complete income declaration is crucial to avoid tax troubles.

- Underreporting income to conceal cash deposits can lead to severe penalties.

- Tax Planning and Compliance:

- Consulting a tax professional can help optimize tax liabilities and ensure compliance.

- Proper planning can mitigate risks associated with cash deposits.

Cash Deposits and Demonetization

- Impact of Demonetization:

- The 2016 demonetization drive aimed to curb black money and promote digital transactions.

- It led to a surge in cash deposits, many of which were scrutinized.

- Long-Term Effects:

- Demonetization accelerated the shift towards digital payments.

- It strengthened the government’s resolve to monitor cash transactions.

Cash Deposits and Other Financial Regulations

- Know Your Customer (KYC) Norms:

- Banks must verify the identity of customers to prevent fraudulent activities.

- KYC norms are essential for monitoring cash deposits.

- Anti-Money Laundering (AML) Standards:

- Banks have stringent AML procedures to detect and report suspicious transactions.

- Cash deposits are subject to AML scrutiny.

- Foreign Exchange Management Act (FEMA):

- FEMA regulates foreign exchange transactions.

- Cash deposits from foreign sources are subject to FEMA compliance.

Cash Deposits and Business Transactions

- Cash Deposit Limits for Businesses:

- While there’s no specific limit, large cash deposits by businesses can attract attention.

- Businesses should maintain proper records to justify cash inflows.

- Digital Payments and GST:

- Promoting digital payments is a government priority.

- GST compliance often necessitates electronic transactions.

Cash Deposits and Individual Taxpayers

- Saving for Specific Goals:

- Cash deposits for short-term goals like buying a car or home down payment might be justified.

- However, large sums should be accompanied by proper documentation.

- Digital Alternatives:

- Using digital payment methods reduces the risk of scrutiny.

- Online banking and digital wallets offer convenience and transparency.

- Tax Planning Strategies:

- Consulting a tax expert can help structure finances to minimize tax implications.

- Diversifying investments can reduce reliance on cash.

FAQs on Cash Deposit Limits

- Is there a strict cash deposit limit?

- No, but exceeding reporting thresholds can lead to scrutiny.

- What happens if I deposit more than ₹10 lakh?

- The bank will report it to the Income Tax Department, and you might need to justify the source of funds.

- Can I avoid taxes by depositing cash in installments?

- No, the Income Tax Department can aggregate deposits over a period.

- Is it safe to deposit large sums of cash?

- It’s generally advisable to use digital payment methods for large transactions.

Conclusion

While there’s no explicit cash deposit limit, the reporting thresholds and the overall regulatory environment emphasize transparency and accountability in financial transactions. Understanding these guidelines is essential for individuals and businesses to avoid potential tax implications and maintain compliance. By embracing digital payments and proper financial planning, taxpayers can mitigate risks and ensure a smooth tax filing process.

Team Chartered Online. Reach us at admin@charteredonline.in