Applicable GST Rate on SEIS, MEIS Scrips, PSLCs & RECs and other similar scrips

The CBIC recently issued Circular No. 46 / 20 /2018 -GST F.No. 354 / 149 / 2017 –TRU dated 6th June, 2018 regarding the classification and applicable GST rate on the Renewable Energy Certificates (RECs) and Priority Sector Lending Certificates (PSLCs).

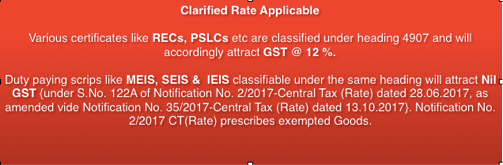

Earlier, in response to a FAQ, it was clarified (vide advertisement dated 27.07.2017), that MEIS and other scrips like SEIS and IEIS are goods classified under heading 4907 and attract 12% GST, which is the general GST rate for goods falling under heading 4907.

Subsequently, the duty credit scrips classifiable under 4907 were exempted from GST, while stock, share or bond certificates and similar documents of title [other than Duty Credit Scrips], classifiable under heading 4907, attract 12% GST.

Later on, Circular No. 34/8/2018- GST dated 01.03.2018 (S.No.3) was issued clarifying that PSLCs are taxable as goods at a standard rate of 18 % under the residual entry S. No. 453 of Schedule III of notification No. 01/2017-Central Tax (Rate).

As a result, there is lack of clarity on the applicable rate of GST on various scrips/ certificates like RECs, PSLCs etc.

The matter has been re-examined. GST rate of 18 % under the residual entry at S.No. 453 of Schedule III of notification No. 01/2017-Central Tax (Rate) applies only to those goods which are not covered under any other entries of Schedule I, II, IV, V, or VI of the notification.

In other words, if any goods are covered under any of the entries of Schedule I, II, IV, V, or VI, the GST rate applicable on them will be decided accordingly, without resorting to the residual entry 453 of Schedule III.

Note further that vide Central Rate No. 11/2018-Central Tax (Rate) ,dt. 28-05-2018 Priority Sector Lending Certificate (PSLC) have been made subject to Reverse Charge Mechanism (RCM)

CA Ankit Gulgulia (Jain)