If you have any query related to ITR filing, processing, etc., you can directly approach the income tax department by filling up a simple online form.The Income Tax department has a form for you to ask all your questions related to tax refunds, ITR processing, etc. Once you submit all the details in the form, you will get a ticket id on the screen as well as on SMS.

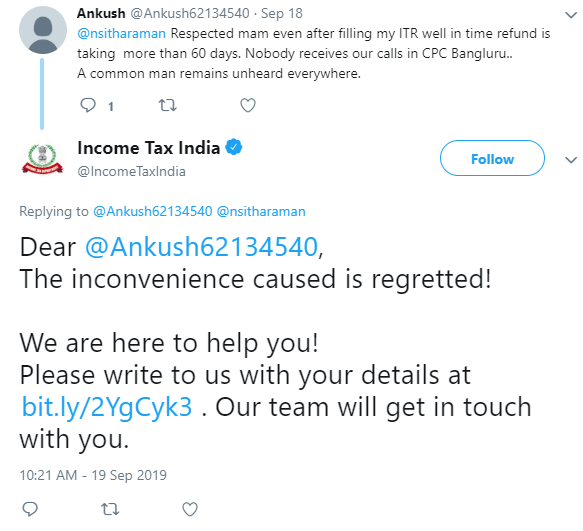

Many people have been posting queries related to their income tax returns, refunds, etc., on the Income Tax department’s official Twitter handle. In response to this, a few days ago, the Income Tax department tweeted the link to an online form that can be filled in by the taxpayer with their queries which will then get answered by the department. “We are here to help you! Please write to us with your details at https://bit.ly/2YgCyk3 . Our team will get in touch with you,” the Income Tax Department tweeted. Several questions are answered directly while for others the department wants you to fill up a form.

How to fill the online form

If you have any query related to ITR filing, processing, etc., you can directly approach the income tax department by filling up a simple online form. This way not only will your query get answered on time from a tax expert, your queries will also remain confidential, unlike asking a query via the Department’s Twitter handle.

The query form issued by the income tax department can be filled here by sharing details like your name, Permanent Account Number (PAN), assessment year, mobile number, email id and social media user id. In the query section you can give details of your concern. Once you submit all the details, you will get a ticket id on the screen as well as on SMS.

You can easily ask questions related to income tax return (ITR) filing, ITR processing or tax refunds. Since the ITR filing season is now over, most taxpayers or assesses are concerned about getting tax refunds on time. Others are concerned about issues related to rectifying their ITR.

Sample of form:

Based on several such queries, the Central Board of Direct Taxes (CBDT) had issued an FAQ (frequently asked questions) list related to ITR filing.

In the meantime, the tax department has started e-assessment process under which a taxpayer will not be required to appear personally if his or her ITR goes for scrutiny. The entire of ITR processing will now be done electronically and even if the taxman has a concern related to your ITR file, questions will sent to you electronically.

The tax department is ensuring that anonymity is maintained in processing of ITR and you may never have to meet any income tax officer. Only in extreme cases will a taxman be appointed.

Be careful:

The income tax department also tracks your IP address so make sure you do not enter any wrong details in the form.

If you make a mistake while entering details, you get the following message displayed on your screen when you submit the form. “You are seeing this page because we have detected Suspicious activity originating from your IP. If you believe that there has been some mistake, please call e-Filing helpdesk for assistance.”

Point to note:

The turnaround time (TAT) to resolve taxpayer queries has not been specified by the income tax department, however, you generally receive a call from a tax expert within one or two days.