How to File E- Return under UP VAT (Uttar Pradesh)

How to File E- Return under UP VAT (Uttar Pradesh)

Steps to file E-Return

A. Preparations to make before Filing Return online :

1. Download Excel Formats...

How to Prepare Project Report for Bank Loan :- A Brief Outlining

How to Prepare Project Report for Bank Loan :- A Brief Outlining

Project Report – Outline Can be Used in Bank Loans for Textile, Manufacturing,...

How to get Food License (FSSAI) In Delhi (NCR) – A Simplified and Practical...

How to get Food License In Delhi (NCR) – A Simplified and Practical Perspective !!

By CA Ankit Gulgulia (Jain)

Recently, it is seen that the...

The Complete Reebok Fiasco – A Study

The Complete Reebok Fiasco - A Study

"Reebok International Limited is a British producer of athletic footwear, apparel, and accessories and is currently a subsidiary...

New Composition Scheme for Works Contractors in Haryana VAT

The much awaited draft notification on Composition scheme for Developers and Works contractors have been released by state government on 5th July, 2014. The same...

How to Face CA Exams

How to Face CA Exams

Cover Page of Book

ICAI has Recently Released it's Publication "How to Face CA Exams".

Click Here to Download its Copy.

Note : As...

Guidance Note on Audit of Banks (2019 Edition) Section A – Statutory Central Audit

Guidance Note on Audit of Banks (2019 Edition) Section A - Statutory Central Audit issued by ICAI on 17th January, 2019.

Publishing Date :- 13.1.2019....

Why Amit Mitra Seeks Changes to Real Estate GST Rules – 5 Major Contentions

We all Know that GST Council is all set to lay the GST Rules for Real Estate pursuant to which 1st April, 2019 changes...

3 Changes in TDS Provisions W.e.f 1st July, 2021

Analysis of 3 Changes in TDS & TCS introduced w.e.f 1st July, 2021

Introduction of TDS on Purchase of Goods @ 0.1%

A new Section 194Q is...

Can Income Tax Assessee Use Different Method For Different Sources of Income?

Can Income Tax Assessee Use Different Method For Different Sources of Income?

By CA Ankit Gulgulia (Jain)

24th June, 2018

Reply :- An issue which arises is...

Delhi Value Added Tax (DVAT) Audit Report – AR-1

Delhi Value Added Tax (DVAT) Audit Report – AR-1

By CA Ankit Gulgulia (Jain). Assisted by Rahul Gupta.

They can be reached at ankitgulgulia@gmail.com

There are twelve parts...

Revised Fee Structure under DVAT w.e.f 17-6-2014

Pursuant to Notification No.F.3(2)/Fin(Rev-I)/2014-15/DSVI/605 - Dated 17-6-2014,fee structure for DVAT registration was amended/enhanced as per the table hereunder:

Sr. No.

Description

Amount (in Rupees)

Manner of payment

1

2

3

4

1.

Application for Registration

1000

Fee...

{Video} All Major Changes in GST – Budget 2019 (W.e.f 1st February, 2019)

https://www.youtube.com/watch?v=Xoi2B_uL8H8&t=1s

Transition Form GST TRAN – 1 – FAQ’s

Transition Form GST TRAN - 1

1. What are Transitional Provisions?

As per the transitional provisions of CGST/ SGST/ UTGST Act, registered person can take credit...

Can this West Bengal AAR GST Ruling Can Disrupt Export of Services & Legal...

Can this West Bengal AAR GST Ruling Can Disrupt Export of Services & Legal Analysis

In case of M/s Global Reach Education Services Pvt Ltd...

NFRA – The Auditor’s BOSS Active w.e.f 24th October, 2018

Vide Notification dated 24th October, 2018, the Ministry of Corporate Affairs has activated the provisions of Section 132 pursuant to which the National...

FAQ’s on XBRL by MCA | Charteredonline

General FAQ's

1. What is XBRL?

XBRL is a language for the electronic communication of business and financial data which is revolutionising business reporting around the...

Applicability of VAT or CST on Inter-State Works Contracts

Introduction

In this article an attempt has been made to clarify the position in regard to the levy of VAT or CST on inter-state works...

Regulating Foreign CA Firms

Regulating Foreign CA Firms

Regulating Foreign CA Firms

Ministry of Corporate Affairs informed the Rajya Sabha that the Indian Chartered Accountant (CA) firms are regulated by the Institute...

Haryana VAT Article by CA Ankit Gulgulia (Jain) :- Published by Print Media, Journals...

Dear Readers,

I am delighted to share with all of you that the Haryana VAT Article on "Developers / Builders" in Haryana has been published...

Facility Sharing Agreements Between Group Companies of MNC is Permissible under FDI

MNCs can lease out assets to group entities: DIPP clarifies

"Facility sharing agreements between group companies through leasing/sub-leasing arrangements for the larger interest of business will...

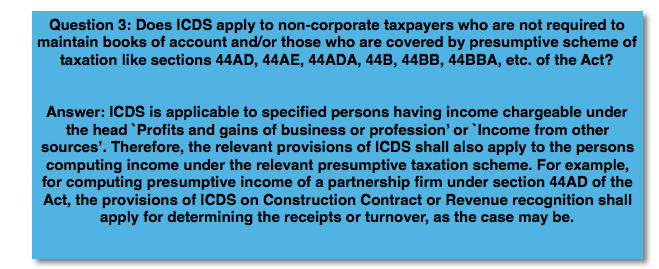

Applicability of Tax Accounting Standards (ICDS) to Taxpayers Covered by Presumptive Tax Schemes

Applicability of Tax Accounting Standards (ICDS) to Taxpayers Covered by Presumptive Tax Schemes

By CA Ankit Gulgulia (Jain)

26th June, 2018

Taxpayers falling under the presumptive tax...

How to be Successful in CA Practice

How to be Successful in CA Practice

By CA Ankit Gulgulia (Jain)

Chartered Accountant

“Being Successful is not a Option, It is your need, It is Mandatory” – CA...

Haryana VAT :- Levy of Surcharge u/s 7A on Composition Dealers (Circular)

Haryana State Government has recently clarified that additional surcharge i.e. at the rate of 5% shall be applicable to all the composition dealers registered...

List of CA Firms in India

A very wide list of CA Firms practicing in India. Refer below for knowing more.

Click Here to get all the Details

(Disclaimer : This is...

Cenvat Credit on GTA–Section 4A (MRP Based Valuation)

The Division Bench of Chhattisgarh High Court in the case of M/s Ultratech Cement Ltd. has allowed the assessee’s appeal against the order of...

Treatment of VAT & CST Security Deposits Made to VAT Department – Can Credit...

Treatment of VAT & CST Security Deposits Made to VAT Department – Can Credit be Claimed in TRAN-1?

Question:- What is going 2 happen to...

Haryana VAT latest Circular dated 10.2.2014 – A Hurting Amendment to Builders & Property...

Haryana VAT Circular dated 10.2.2014 on Builders - Takes a U-Turn on Valuation under Composition scheme to hurt the Builder's and Property Buyers by...

What is Interest Subvention Scheme–How Does it Work in Real Estate and Government’s Policy...

What is Interest Subvention Scheme – How Does it Work in Real Estate and Government’s Policy Making

The literary meaning of subvention that is guarantee...

How to Become CFA In India – Exams, Fees, Books & FAQ’s

CFA India - CFA (Course, Exams, Membership In India, Study Books & Other FAQ's)

Initially, CFA (i.e. Chartered Financial Analyst) Course could be either pursued...