Home Search

how to - search results

If you're not happy with the results, please do another search

How To Use Prompt Chaining in Chat GPT {Case Study with Live Example for...

Prompt chaining is a powerful technique to enhance ChatGPT's capabilities by breaking down complex tasks into smaller, sequential steps. Here's how you can effectively...

How to Disclose Foreign ESOP’s in Schedule FA of ITR

1. IntroductionSchedule FA addressing the disclosure of foreign assets, was introduced as an integral component of the Income Tax Return Form (ITR) from the...

S2 Form in NPS – Detailed Guide on What it is, How to Fill...

The National Pension System (NPS) offers a secure and long-term savings option for retirement planning in India. Once you've subscribed to NPS, it's crucial...

ROC Charge – How to Create, Modify, View & File Satsifaction of Charges on...

In the Indian corporate landscape, transparency and accountability are paramount. The Companies Act, 2013, plays a vital role in ensuring this by mandating the...

How to Make APSPDCL Bill Payment

Paying your APSPDCL (Andhra Pradesh Southern Power Distribution Company Limited) electricity bill has never been easier. With several convenient options available, you can choose...

All Mutual Fund Investments in One Place – How to View ?

Demystifying Your Mutual Fund Investments: A Guide to Consolidated Account Statements (CAS)

Investing in mutual funds can be a smart way to grow your wealth...

What is Form 16? How To Download Form 16?

TDS is deducted on your salary income and deposited with the Income Tax Department (IT Department) every month. Form 16 is a certificate issued...

How To Check Income Tax Refund Status For FY 2023-24 (AY 2024-25)?

If you have paid more taxes than your actual liability, you can request a refund for the excess amount. The Income Tax Department offers...

How To Save Tax Legally?

We've all heard the famous...

45 Day Rule Made for MSME’s Benefit is Hurting MSME’s very Badly – Here’s...

While the government has intended to protect MSMEs and ensure timely payments, this new regulation has raised concerns in the market and has led to...

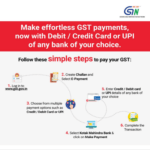

How to Make GST Payment by UPI on Portal

The Goods and Services Tax Network ( GSTN ) has issued a new advisory, dated January 19, 2023, introducing additional payment options for those...

DDA mega e-auction: Here is how to bid for over 450 properties in Delhi

The Delhi Development Authority (DDA) is holding a mega e-auction of over 450 properties in Delhi. The auction will be held online from October...

How to Enroll as Unregistered Suppliers to Supply Goods Through E-Commerce Portals

IntroductionThe Goods and Services Tax Network (GSTN) has provided a facility for enrollment of unregistered suppliers to facilitate the supply of goods through e-commerce...

How to Save Taxes on Capital Gains from Sale of Residential Property: A Comprehensive...

IntroductionSelling a residential property can be a major financial transaction, and it is important to be aware of the tax implications. Capital gains tax...

Can Indian Start Business in Singapore? How to Register a Business in Singapore from...

IntroductionSingapore has emerged as a popular destination for Indian startups and entrepreneurs in recent years. The country's pro-business environment, low taxes, and easy access...

How to Reclaim Shares and Dividend from IEPF: A Comprehensive Guide

IntroductionThe Investor Education and Protection Fund (IEPF) is a government-run fund that holds unclaimed and unpaid dividends and shares. If you have any unclaimed...

MSME Grants – How Much, How to Apply, What are Schemes and All the...

MSME grants are financial assistance provided by the government to micro, small, and medium enterprises (MSMEs). MSMEs are businesses that have an investment in...

How to Face Transfer Pricing Audits with Preparation & Perseverance

Introduction: Transfer pricing audits can be a daunting experience for multinational companies. With tax authorities around the world becoming increasingly aggressive in their enforcement...

How to Download Income Tax Department’s AIS App for Taxpayers – Android and iPhone

The Income Tax Department has launched a Mobile app for Taxpayers to view Annual Information Statement (AIS).AIS App is a free mobile application, provided by the...

How to file ITR of past years?

ITR filing comes with a due date, if we do not file the ITR within the due date, we can file a belated ITR...

How to Reduce your Personal Income Tax for Salaried person in India A.Y. 2023-24

The Indian Income Tax Act, 1961 is the primary legislation governing taxation in India. It provides for all aspects of taxation, from levy and...

How to Get Back your Shares from Investor Education and Protection Fund

Procedure to claim RefundThe procedure to claim IEPF Refund by filing Form IEPF-5 is explained in detail below:Download Form IEPF-5The claimant needs to download...

Did You Received Notice / SMS from Compliance Portal of Income Tax ? –...

By CA Ankit Gulgulia (Jain)The SMS has caused panic among taxpayers as the deadline to reply is very shorthand as 31st March is the...

How to Apply for Un-blocking of E-Way Bill generation facility

CBIC enables Online filing of application Form GST EWB 05 by the Taxpayer for un-blocking of E-Way Bill generation facilityOnline filing of application (Form...

Step by Step Guide on How to Submit Response to Scrutiny Notice on Income...

By CA Ankit Gulgulia (Jain)Step by Step Guide on How to Submit Response to Scrutiny Notice on Income Tax Portal under New Faceless Assessment...

How to avoid excess CGST Input credit accumulation by doing this small mind application

So as you would be aware that while adjusting the input tax credit a lot of assessees face a problem that a large amount...

How to Automate CA Practices of Small Firms

Many Medium & Small Sized Chartered Accounting firms need to automate their working processes as a solution to a large number of problems relating...

7 Key Benefits of MSME Registration in this COVID Crunch – How to Take...

Dear Friends,As you all would be aware recently our Finance Minister Smt Nirmala Sitharaman dedicated a lot many benefits to the MSME sector in...

E-Invoice under GST – Applicability, Concept, How to Generate, Legal Backdrop and Format

E-Invoice under GST – Applicability, Concept, How to Generate, Legal Backdrop and FormatBy CA Ankit Gulgulia (Jain)The Biggest buzz in GST currently is...